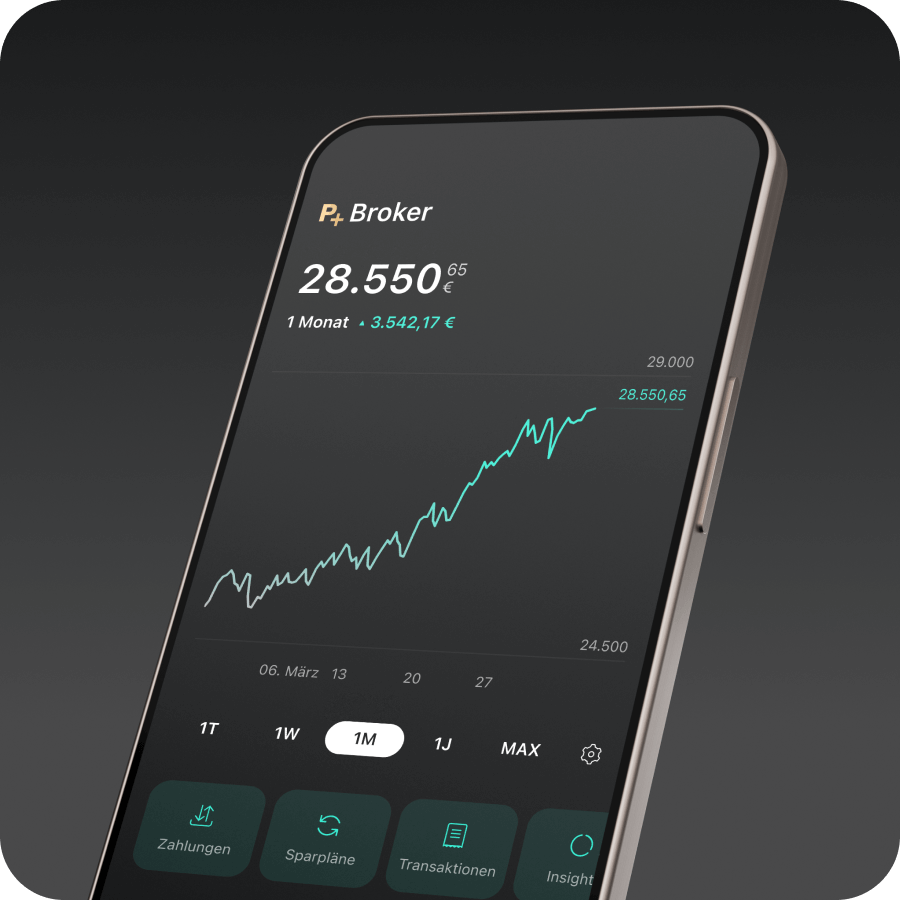

PRIME+ Broker

Trading-Flatrate

und 2 % Zinsen

Unbegrenzt traden1 und 2 % Zinsen p.a.* auf unbegrenztes Guthaben erhalten.

Kapitalanlagen bergen Risiken.

1PRIME+ Broker: 0 € für Trades ab 250 € Volumen, darunter 0,99 €. 0 € für Sparplanausführungen. Ggf. fallen Produktkosten, Spreads, Crypto-Gebühren und/oder Zuwendungen an. Mehr erfahren.

Der einzige Broker, den Du brauchst

PRIME+ bietet Dir alles, was Du zum erfolgreichen Investieren benötigst.

1 PRIME+ Broker: 0 € für Trades ab 250 € Volumen, darunter 0,99 €. 0 € für Sparplanausführungen. Ggf. fallen Produktkosten, Spreads, Crypto-Gebühren und/oder Zuwendungen an. Mehr erfahren.

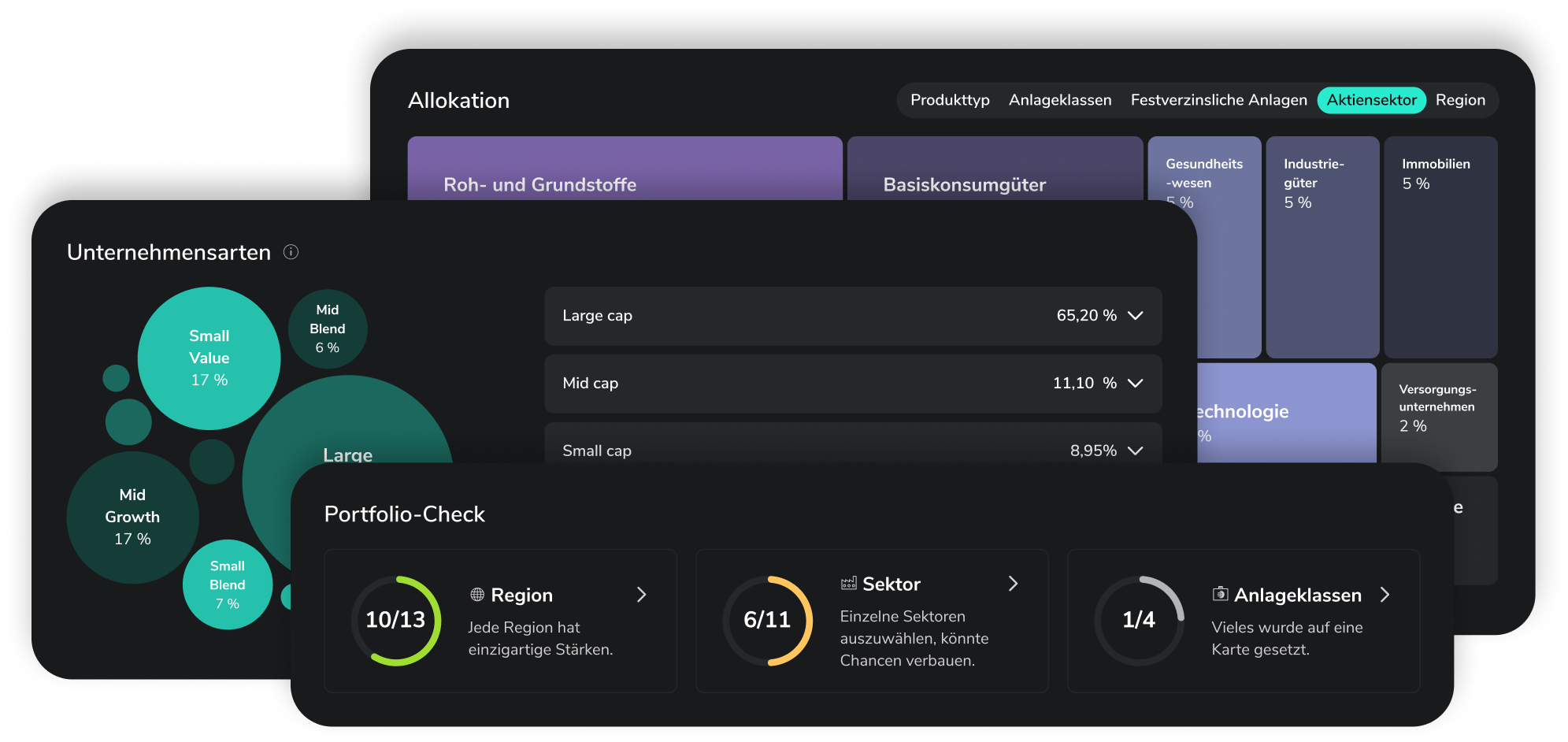

Noch mehr smarte Features

Neben dem Portfolio-Analyse-Tool Insights verbessern weitere exklusive PRIME+ Features Deine Trading Experience.

Portfolio-Gruppen

Ordne Deine Wertpapiere wie du möchtest, z. B. nach Sparziel oder Strategie. Mehr erfahren.

Preisalarme

Nie mehr den idealen Preis zum Kauf oder Verkauf eines Wertpapiers verpassen. Mehr erfahren.

Smart Predict

Erfahre, mit welcher Wahrscheinlichkeit Deine aufgegebene Order innerhalb der nächsten Stunde ausgeführt wird. Mehr erfahren.

Wertpapiere vergleichen

Kursentwicklung, Dividenden und Finanzkennzahlen von bis zu 3 Aktien miteinander vergleichen. Mehr erfahren.

Einfache Verwaltung von Transaktionen

Mit nur zwei Klicks alle Broker-Transaktionen in einer CSV-Datei exportieren. Mehr erfahren.

Unbegrenzt handeln

Traden, so viel Du willst mit besten Konditionen im PRIME+ Broker.

Beliebt |

||

|---|---|---|

FREE |

PRIME+ |

|

Kosten1 |

0,99 € / Trade |

0,00 € / Trade |

Zinsen |

2 % p.a.* |

2 % p.a.* |

Guthabenverteilung |

Scalable, Partnerbanken und |

Scalable und Partnerbanken |

Crypto |

0,99 % Spread |

0,69 % Spread |

Credit |

4,24 % p.a. |

3,24 % p.a. |

Weitere Features |

Begrenzt |

Vollversion |

1 PRIME+ Broker: 0 € für Trades ab 250 € Volumen, darunter 0,99 €. FREE Broker: 0 € für Käufe von PRIME ETFs (alle ETFs von Amundi, iShares, Xtrackers) ab 250 € Volumen, 0,99 € für sonstige Trades. Alle Broker-Modelle: 0 € für Sparplanausführungen. Ggf. fallen Crypto-Gebühren, Produktkosten, Spreads und/oder Zuwendungen an. Kosten im Detail vergleichen.

2 Variable Sollzinsen, quartalsweise Zahlung.

Gebühren im Check

Ab wann lohnen sich die Gebühren für PRIME+? Das verdeutlicht das nachfolgende Beispiel.

Ab 6 Trades

kann sich PRIME+ lohnen

In einem Monat machst Du 6 Trades. Das können sowohl Käufe als Verkäufe mit einem Ordervolumen von jeweils 250 € oder mehr sein.

So lohnt sich PRIME+:

FREE Broker: Du zahlst 5,94 € Ordergebühren. | |

PRIME+ Broker: Du zahlst nur 4,99 €/Monat1. Und somit sparst Du Dir fast 1 € im Vergleich zum FREE Broker. |

1 PRIME+ Broker: 0 € für Trades ab 250 € Volumen, darunter 0,99 €. FREE Broker: 0 € für Käufe von PRIME ETFs (alle ETFs von Amundi, iShares, Xtrackers) ab 250 € Volumen, 0,99 € für sonstige Trades. Alle Broker-Modelle: 0 € für Sparplanausführungen. Ggf. fallen Crypto-Gebühren, Produktkosten, Spreads und/oder Zuwendungen an. Kosten im Detail vergleichen.

Häufig gestellte Fragen

Du kannst Preisalarme für alle Wertpapiere einrichten und jederzeit anpassen. Klicke dafür auf das gewünschte Wertpapier und dann auf der Übersichtsseite des Wertpapiers rechts oben auf die Glocke. Du kannst mehrere Preisalarme für das Wertpapier anlegen. Die Anzahl der aktiven Preisalarme erkennst Du als Zahl auf dem Glocken-Symbol.

Im PRIME+ Broker können beliebig viele Preisalarme eingerichtet werden.

Smart Predict ist eine Funktion, die bei der Aufgabe von Limit- und Stop-Orders zum Einsatz kommt. Sie zeigt die Wahrscheinlichkeit an, mit der eine Limit- oder Stop-Order innerhalb der nächsten Stunde ausgeführt wird. Die Wahrscheinlichkeiten, die dabei angezeigt werden, aktualisieren sich automatisch und in Echtzeit, wenn Du den gewünschten Preis änderst oder der Kurs des Wertpapiers schwankt.

Du kannst Deine Wertpapiere in Portfoliogruppen strukturieren. Logge Dich dafür im Scalable Broker ein und rufe das Feld Gruppe erstellen über Deine Portfolioansicht auf. Gib Deiner Portfolio-Gruppe einen Namen und schon kannst Du einzelne Wertpapiere aus Deinem Gesamtportfolio auswählen und zur Gruppe hinzufügen. Bearbeiten ist jederzeit möglich: Einfach Wertpapiere hinzufügen oder entfernen, Gruppe umbenennen oder löschen.

Für nur 4,99 € im Monat erhältst Du im PRIME+ Broker Zugang zu einer umfangreichen Investmentplattform mit Handel von Aktien, Fonds, ETFs und ETPs ohne Ordergebühren* ab einem Ordervolumen von 250 € sowie unbegrenzten Sparplänen. Das Preismodell lohnt sich schon ab drei Trades pro Monat. Zudem erhältst Du eine attraktive Verzinsung Deines nicht investierten Guthabens - alles an einem Ort. Zusätzlich zu den finanziellen Vorteilen sorgen bei beiden Preismodellen exklusive Funktionen dafür, dass Du den Überblick über Dein Portfolio behältst und das Trading erleichtert wird.

*Ggf. fallen Produktkosten, Spreads, Zuwendungen und Crypto-Gebühren an.

Kunden und Kundinnen erhalten 2 % Zinsen p.a.* (variabel) auf nicht investiertes Guthaben bis zu 100.000 € in FREE und auf unbegrenztes Guthaben in PRIME+.

Du kannst jederzeit zwischen den verschiedenen Preismodellen (FREE Broker, PRIME+ Broker) wechseln. Gehe hierfür in Deinem Kundenbereich auf den Reiter "Profil". Unter "Produkte" findest Du hier die Möglichkeit, Deinen Broker-Plan jederzeit zu ändern, indem Du auf “Plan wechseln” klickst. Bitte beachte, dass die Änderung sofort wirksam wird.

Achtung: Klicke bitte nicht auf "Broker kündigen". Dadurch kündigst Du Dein gesamtes Depot, dieser Vorgang kann nicht rückgängig gemacht werden.

In der Trading-Flatrate sind alle Sparpläne gebührenfrei1 enthalten. Ebenso sind unbegrenzt viele Trades auf der European Investor Exchange und auf gettex ohne Ordergebühren ab 250 € Ordervolumen enthalten. Trades unter 250 € kosten 0,99 € auf der European Investor Exchange und auf gettex. Crypto-ETPs unterliegen einem reduzierten Spread-Aufschlag (s.u.) im Handel und beim Sparplan. Bei Orderausführungen über den Börsenplatz Xetra fallen unabhängig vom Preismodell 3,99 € pro Trade zzgl. einer Handelsplatzgebühr (0,01 % des Ordervolumens, mind. 1,50 €) an.

1Ggf. fallen Produktkosten, Spreads, Zuwendungen und Crypto-Gebühren an.