World Portfolio Classic investment strategy

Invest in the whole world with ETFs

Automatically invest in all major world regions as well as bonds and commodities for further diversification. Start building up wealth with an investment amount from €20.

Investing involves risks.

World Portfolio Classic

Invest globally-diversified with ETFs – optionally with gold

World Portfolio

Classic

ETF portfolio diversified globally across the most important world regions and with bonds and commodities.

World Portfolio

Classic + Gold

The World Portfolio Classic supplemented by physical gold as possible inflation protection.

Is the World Portfolio Classic a fit for me?

The World Portfolio Classic might be of interest to you if you:

want to invest automated and broadly diversified with ETFs, | |

at the same time diversify broadly across stocks, bonds and commodities, | |

as well as build and increase your wealth in the medium and long term. |

The World Portfolio Classic + Gold might be of interest to you if you:

|

want to add physical gold to your portfolio as a possible inflation hedge. |

Investing involves risks.

Do you want to discover more? Our further strategies offer different investment focuses.

How the World Portfolio Classic works

Invest broadly diversified in the most important world regions, bonds and commodities.

The World Portfolio aims to cover the most important markets worldwide, including more than 7,800 stocks from all investable regions.

All sectors and various asset classes are taken into account, which makes it the ideal ETF portfolio construction for a globally diversified investment.

The World Portfolio Classic in detail

What is the difference to a simple investment in an MSCI World ETF or FTSE All-World ETF?

World Portfolio Classic |

FTSE All-World ETF |

MSCI World ETF |

|

|---|---|---|---|

Diversification with stocks, bonds and commodities 1 |

|

|

|

ETF selection by Scalable 2 |

|

|

|

Permanent portfolio monitoring 3 |

|

|

|

Individual equity quota 4 |

|

|

|

Includes emerging markets 5 |

|

|

|

Includes small caps 6 |

|

|

|

0% withholding tax on US stocks 7 |

|

|

|

Withdrawal plan 8 |

|

|

|

Savings plan |

|

|

|

Number of companies in the portfolio 9 |

7.800 |

3.700 |

1.500 |

Costs 10 |

0.75% p.a. |

Fees for securities account |

Fees for securities account |

Possible addition of gold |

|

|

|

2 Regular review of ETF selection with regards to composition, diversification, costs, tax efficiency, tracking quality, liquidity and replication by Scalable Capital experts.

3Daily monitoring of the portfolio and annual tax optimisation through Scalable Capital's investment technology. If rebalancing is necessary or better ETFs are available, we trade for you. Tax optimisation allows you to make the most of your exemption order, saving up to €560 in taxes annually.

4 With the World Portfolio Classic, the equity weighting and thus the portfolio risk can be set in 10% increments between 30-100%. If the portfolio weights deviate too much from the target weights, rebalancing takes place. In the case of ETFs on the FTSE All-World and MSCI World, on the other hand, the equity quota is fixed at 100%.

5,6 The addition of shares from emerging markets and small caps increases the diversification of the portfolio. The World Portfolio Classic invests in small caps and achieves a market coverage of up to 99% of global market capitalisation, while ETFs on the MSCI World or FTSE All-World typically achieve a market coverage of only 85% and 90%, respectively.

7 Through the USA ETF used, the withholding tax on dividends from U.S. equities can be reduced to 0%, compared with 30% for physically replicating ETFs (or 15% if the fund is domiciled in Ireland). The tax benefit is already reflected in the ETF's prices and may be reflected in better performance. The majority or the largest ETFs by fund volume on the FTSE All-World and MSCI World are physically replicating, while the Scalable World Portfolio Classic uses a synthetically replicating USA ETF.

8 The optional withdrawal plan enables a monthly payment of constant amounts of money, such as a monthly pension, to the reference account. Most brokers available in Germany do not offer a withdrawal plan on ETFs.

9 Number of companies in the portfolio (rounded).

10 Ongoing costs per year as a percentage of invested assets. The product costs are already included in the prices of the ETFs and are not charged separately. For ETFs on the FTSE All-World and MSCI World Index, the costs (TER) of the largest ETF by fund volume were taken as product costs.

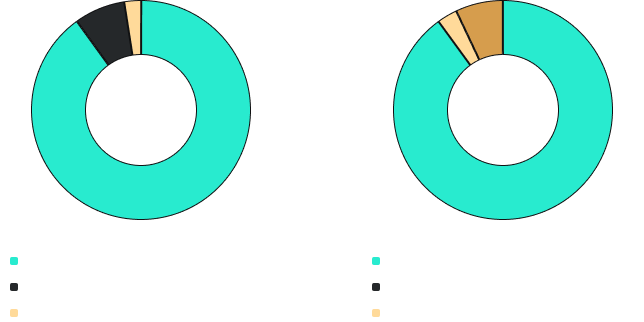

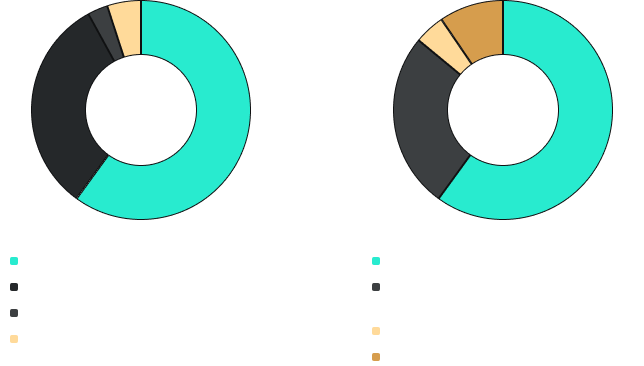

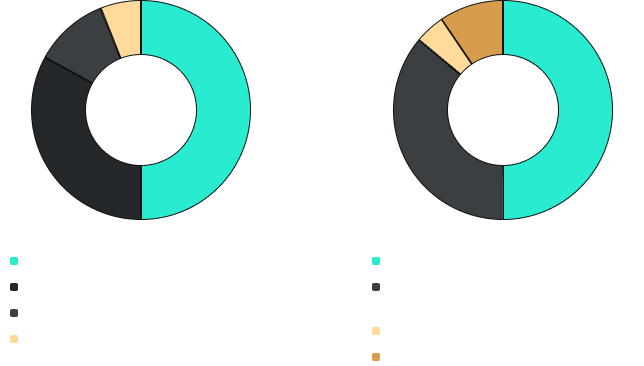

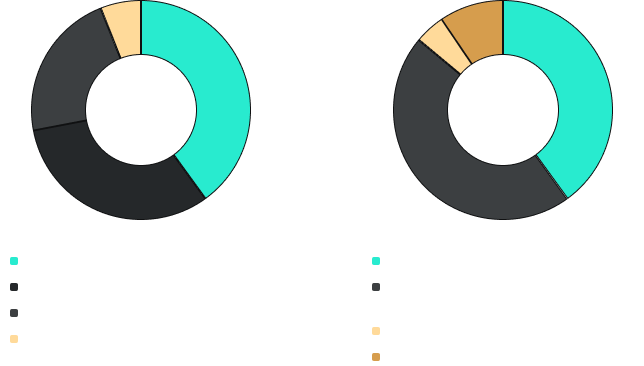

Portfolio allocation

The World Portfolio Classic invests in equities, bonds and commodities – and optionally in gold. The higher the equity allocation, the higher the potential return with increasing risk.

Classic 100 |

Classic 90 |

|

|---|---|---|

Equities |

100% |

90% |

iShares S&P 500 Swap UCITS ETF USD (Acc) |

56.50% |

50.80% |

Amundi Stoxx Europe 600 UCITS ETF |

19.00% |

17.10% |

Amundi Prime Japan UCITS ETF DR (C) |

5.20% |

4.70% |

L&G Asia Pacific ex Japan Equity UCITS ETF USD (Acc) |

3.00% |

2.70% |

iShares MSCI World Small Cap UCITS ETF USD (Acc) |

5.30% |

4.80% |

iShares Core MSCI EM IMI UCITS ETF USD (Acc) |

9.00% |

8.10% |

Xtrackers CSI300 Swap UCITS ETF 1C |

2.00% |

1.80% |

Bonds |

- |

7.50% |

iShares USD Treasury Bond 7-10y UCITS ETF EUR Hedged (Dist) |

- |

6.50% |

Invesco Euro Government Bond 1-3y UCITS ETF |

- |

1.00% |

Gold & Commodities |

- |

2.50% |

Xtrackers Bloomberg Commodity ex-Agriculture & Livestock Swap UCITS ETC |

- |

2.50% |

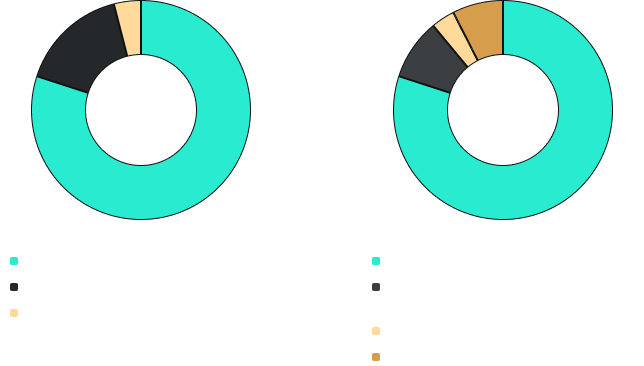

Classic 80 |

Classic 70 |

|

|---|---|---|

Equities |

80% |

70% |

iShares S&P 500 Swap UCITS ETF USD (Acc) |

45.20% |

39.60% |

Amundi Stoxx Europe 600 UCITS ETF |

15.20% |

13.30% |

Amundi Prime Japan UCITS ETF DR (C) |

4.10% |

3.60% |

L&G Asia Pacific ex Japan Equity UCITS ETF USD (Acc) |

2.40% |

2.10% |

iShares MSCI World Small Cap UCITS ETF USD (Acc) |

4.30% |

3.70% |

iShares Core MSCI EM IMI UCITS ETF USD (Acc) |

7.20% |

6.30% |

Xtrackers CSI300 Swap UCITS ETF 1C |

1.60% |

1.40% |

Bonds |

16.00% |

25.00% |

iShares USD Treasury Bond 7-10y UCITS ETF EUR Hedged (Dist) |

13.00% |

16.00% |

Invesco Euro Government Bond 1-3y UCITS ETF |

3.00% |

3.00% |

Xtrackers II EUR Overnight Rate Swap UCITS ETF 1C |

- |

4.00% |

VanEck J.P. Morgan EM Local Currency Bond UCITS ETF - USD A |

- |

2.00% |

Gold & Commodities |

4.00% |

5.00% |

Xtrackers Bloomberg Commodity ex-Agriculture & Livestock Swap UCITS ETC |

4.00% |

5.00% |

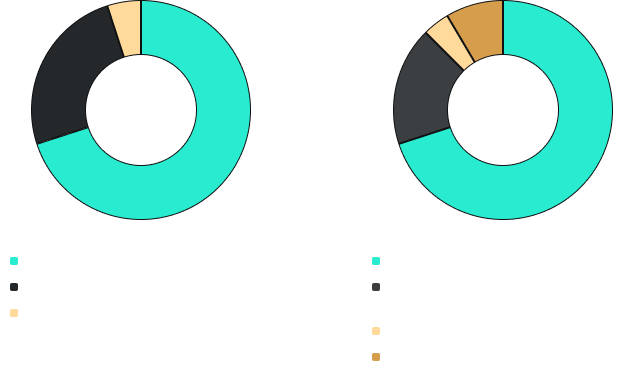

Classic 60 |

Classic 50 |

|

|---|---|---|

Equities |

60% |

50% |

iShares S&P 500 Swap UCITS ETF USD (Acc) |

33.90% |

28.20% |

Amundi Stoxx Europe 600 UCITS ETF |

11.40% |

9.50% |

Amundi Prime Japan UCITS ETF DR (C) |

3.10% |

2.60% |

L&G Asia Pacific ex Japan Equity UCITS ETF USD (Acc) |

1.80% |

1.50% |

iShares MSCI World Small Cap UCITS ETF USD (Acc) |

3.20% |

2.70% |

iShares Core MSCI EM IMI UCITS ETF USD (Acc) |

5.40% |

4.50% |

Xtrackers CSI300 Swap UCITS ETF 1C |

1.20% |

1.00% |

Bonds |

35.00% |

44.00% |

iShares USD Treasury Bond 7-10y UCITS ETF EUR Hedged (Dist) |

19.00% |

18.00% |

Invesco Euro Government Bond 1-3y UCITS ETF |

5.00% |

6.00% |

Xtrackers II EUR Overnight Rate Swap UCITS ETF 1C |

5.00% |

5.00% |

VanEck J.P. Morgan EM Local Currency Bond UCITS ETF - USD A |

3.00% |

4.00% |

iShares EUR Corp Bond 1-5yr UCITS ETF EUR (Dist) |

- |

3.00% |

iShares EUR Ultrashort Bond UCITS ETF EUR (Dist) |

3.00% |

6.00% |

iShares J.P. Morgan USD EM Corp Bond UCITS ETF USD (Dist) |

- |

2.00% |

Gold & Commodities |

5.00% |

6.00% |

Xtrackers Bloomberg Commodity ex-Agriculture & Livestock Swap UCITS ETC |

5.00% |

6.00% |

Classic 40 |

Classic 30 |

|

|---|---|---|

Equities |

40% |

30% |

iShares S&P 500 Swap UCITS ETF USD (Acc) |

22.60% |

16.90% |

Amundi Stoxx Europe 600 UCITS ETF |

7.60% |

5.70% |

Amundi Prime Japan UCITS ETF DR (C) |

2.10% |

1.50% |

L&G Asia Pacific ex Japan Equity UCITS ETF USD (Acc) |

1.20% |

1.00% |

iShares MSCI World Small Cap UCITS ETF USD (Acc) |

2.10% |

1.60% |

iShares Core MSCI EM IMI UCITS ETF USD (Acc) |

3.40% |

2.30% |

Xtrackers CSI300 Swap UCITS ETF 1C |

1.00% |

1.00% |

Bonds |

54.00% |

65.00% |

iShares USD Treasury Bond 7-10y UCITS ETF EUR Hedged (Dist) |

14.00% |

12.00% |

Invesco Euro Government Bond 1-3y UCITS ETF |

8.00% |

8.00% |

Xtrackers II EUR Overnight Rate Swap UCITS ETF 1C |

5.00% |

5.00% |

VanEck J.P. Morgan EM Local Currency Bond UCITS ETF - USD A |

5.00% |

5.00% |

iShares EUR Corp Bond 1-5yr UCITS ETF EUR (Dist) |

5.00% |

10.00% |

Xtrackers II EUR High Yield Corporate Bond UCITS ETF 1C |

5.00% |

0.00% |

iShares EUR Ultrashort Bond UCITS ETF EUR (Dist) |

10.00% |

13.00% |

iShares J.P. Morgan USD EM Corp Bond UCITS ETF USD (Dist) |

2.00% |

2.00% |

Gold & Commodities |

6.00% |

5.00% |

Xtrackers Bloomberg Commodity ex-Agriculture & Livestock Swap UCITS ETC |

6.00% |

5.00% |

Current investment universe

Asset class | Financial product | |

|---|---|---|

Equities | Equities U.S. | iShares S&P 500 Swap ETF |

Equities Europe | Amundi Stoxx Europe 600 UCITS ETF | |

Equities Japan | Amundi Prime Japan ETF | |

Equities Asia and Pacific Area | L&G Asia Pacific ex Japan Equity ETF | |

Equities Global (Small Caps) | iShares MSCI World Small Cap ETF | |

Equities Emerging Markets | iShares Core MSCI Emerging Markets IMI ETF | |

Equities China | Xtrackers CSI 300 Swap ETF | |

Government Bonds | Government Bonds U.S. | iShares $ Treasury Bond 7-10yr EUR hedged ETF |

Government Bonds Euro Zone | Invesco Euro Government Bond 1-3 Year ETF | |

Government Bonds Emerging Markets | VanEck J.P. Morgan EM Local Currency Bond ETF | |

Money market Euro | Xtrackers EUR Overnight Rate Swap ETF | |

Corporate Bonds | Corporate Bonds Euro | iShares EUR Corporate Bond 1-5yr ETF |

Corporate Bonds (short maturity) | iShares Corp Ultrashort Bonds ETF | |

Corporate Bonds Euro | Xtrackers EUR High Yield Corporate Bond ETF | |

Corporate Bonds Emerging Markets | iShares JPM USD EM Corp Bond ETF | |

Commodity | Commodities Global | Xtrackers BBG Commodity ex-Ag Swap ETF |

Gold | WisdomTree Core Physical Gold ETC |

|

CostsThe World Portfolio Classic incurs ETF costs of 0.12% and the World Portfolio Classic + Gold 0.11% per year as well as ongoing costs for portfolio management and trading of 0.49 to 0.75% per year, depending on the investment amount. Learn more. |

| |

SecurityThe ETFs used in the portfolio are special assets and are, in case of insolvency of Scalable Capital, protected to an unlimited extent. InterestInvest is therefore also suitable for larger investment amounts. |

Frequently asked questions

The World Portfolio Classic is designed as a broadly diversified basic investment for ETF-based asset accumulation. It contains all the important asset classes, including stocks, bonds and commodities.

In addition to the World Portfolio Classic, we also offer two other variants:

Creating a global portfolio on your own is certainly possible, but it entails risks and can have disadvantages. It requires extensive research, monitoring and adjustments in order to optimise it and maintain the necessary diversification and desired risk category. This means a lot of effort and time. In addition, the constant transactions can sometimes result in high costs.

With Scalable Wealth, you can sit back and relax as we manage the portfolio for you. Our experienced team regularly reviews the composition of the portfolio and adjusts it if necessary. All transactions are already included in the management. This saves you time and effort.

With all our portfolios, we offer a professional and holistic solution for wealth growth and management for ambitious investors. We consistently focus on the opportunities offered by the capital markets and only invest in the best and most cost-effective ETFs.

It is not possible or advisable to invest in all countries, as the capital markets of each country are developed differently around the world. Legal certainty also plays an important role in the selection of countries in order to prevent states from expropriating their companies (and therefore shareholders).

The World Portfolio Classic invests in established companies from 47 developed and emerging countries (as of February 2024). By including small, medium-sized and large companies, the portfolio achieves market coverage of up to 99 percent of the investable market capitalisation and is therefore significantly better diversified than comparable funds and ETFs.

No, there is no minimum investment period. However, the World Portfolio Classic strategy is more suitable for a medium to long-term investment horizon. This is because it is not possible to smooth out market fluctuations to the same extent over short periods of time.

Investing in the capital market brings opportunities, but also certain risks. Provided you have a sufficiently long investment horizon, however, the opportunities generally outweigh the risks. It is therefore not without reason that many international pension schemes invest in the capital market and in the stock market in particular.

When investing, you should be aware that price fluctuations are a natural part of the capital market and that capital losses cannot be ruled out. Historically, however, global stock markets have always performed well over time despite short-term fluctuations*. By diversifying across thousands of companies worldwide, we minimise the risk associated with investing in individual companies. This allows investors to benefit from global growth opportunities while minimising fluctuations.

At the beginning of the investment process, we use a questionnaire to find out the investor's personal risk profile and then suggest suitable investment strategies and share ratios.

We collected more frequently asked questions here.