World Portfolio ESG investment strategy

Investing with ESG focus

Invest automatically in a globally diversified ETF portfolio that meets environmental, social and governance criteria with the World Portfolio ESG.

Investing involves risks.

Is the World Portfolio Classic a fit for me?

The World Portfolio Classic might be of interest to you if you want to:

invest in the stock market in an automated, broadly diversified manner using ETFs, | |

combine the investment with your ecological, social and ethical morals | |

as well as build and increase your wealth in the medium to long term. |

Investing involves risks.

Do you want to discover more? Our further strategies offer different investment focuses.

World Portfolio ESG

Invest money responsibly with ETFs.

For the composition of the portfolio strict criteria are applied: only equity ETFs are used that take the SRI standard (Socially Responsible Investing) into account.

Globally diversified ETF portfolio that takes into account environmental, social and governance (ESG) criteria. | |

Exclusion of companies that earn money with controversial weapons or tobacco or do not meet the requirements of the UN Global Compact. | |

Best-in-class filter in ETF selection: only those who meet SRI criteria are subsequently selected. |

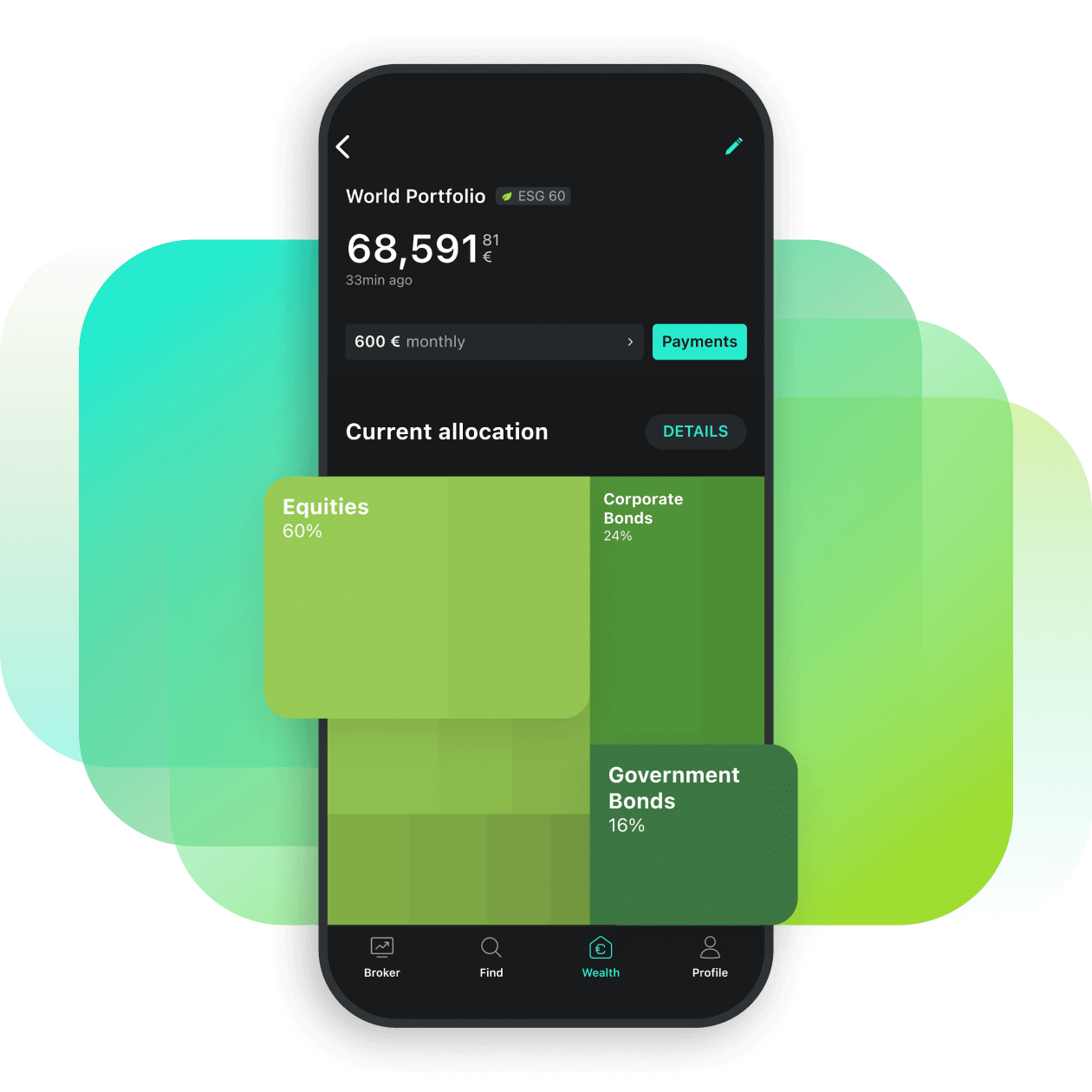

Portfolio allocation

Your portfolio is composed of 30 to 100% depending on the individually selected equity ratio. This means that the portfolio can range from one that is entirely made up of corporate and government bonds to one that is purely invested in equities. With the latter, you are most exposed to the fluctuations on the global stock markets. As a premium for this risk, higher returns can be expected in the long term than with an investment with a bond component. The following examples show how the portfolios are composed depending on the selected equity ratio.

Performance at a glance

Note: Past performance is not a reliable indicator of future performance.

Current investment universe

Asset class | Financial product | |

|---|---|---|

ESG | Equities USA | iShares MSCI USA SRI ETF |

Equities Europe | iShares MSCI Europe SRI ETF | |

Equities Japan | Amundi MSCI Japan SRI PAB ETF | |

Equities Asia Pacific | Amundi MSCI Pacific ex Japan SRI PAB ETF | |

Equities Global (Small Caps) | HSBC MSCI World Small Cap ESG ETF | |

Equities Emerging Markets | Amundi MSCI Emerging Markets SRI PAB ETF | |

Government Bonds USA | Xtrackers US Treasuries EUR Hedged ETF | |

Government Bonds Euro zone | Vanguard Eurozone Government Bond ETF | |

Government Bonds Emerging Markets | VanEck Vectors J.P. Morgan EM Local Currency Bond ETF | |

Government Bonds Inflation Protected | iShares Global Inflation Linked Govt Bond EUR Hedged ETF | |

Corporate Bonds USA | iShares USD Corporate Bond ESG EUR Hedged ETF | |

Corporate Bonds Europe | iShares Euro Corporate Bond ESG ETF | |

Commodities Global | Xtrackers Bloomberg Commodity ex-Agriculture & Livestock Swap ETF |

|

CostsInterestInvest incurs ETF costs of 0.19% per year as well as ongoing costs for portfolio management and trading of 0.49 to 0.75% per year, depending on the investment amount. Learn more. |

| |

SecurityThe ETFs used in the portfolio are special assets and are, in case of insolvency of Scalable Capital, protected to an unlimited extent. InterestInvest is therefore also suitable for larger investment amounts. |