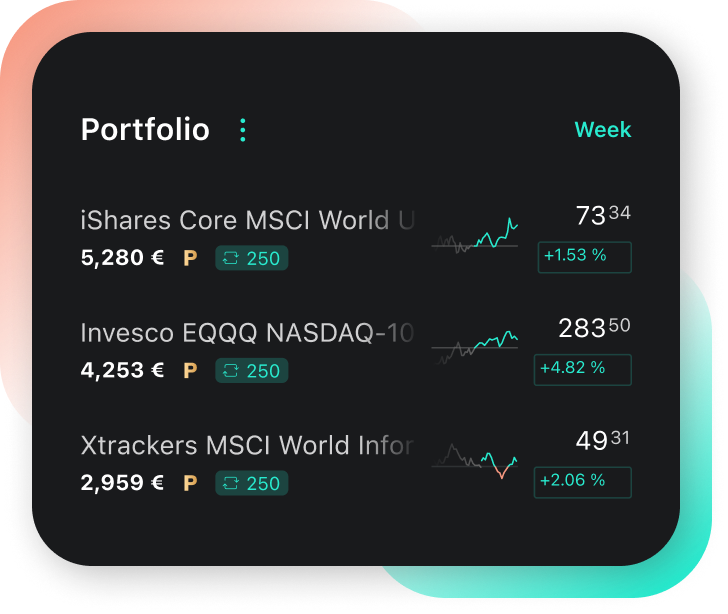

ETF savings plans from €1 savings rate

Build up wealth in the long term with ETF savings plans

Invest cost-effectively and broadly diversified from as little as €1. Set up savings plans on 2,700 ETFs now – in the Scalable Broker.

Investing involves risks.

Saving – just the way you want it

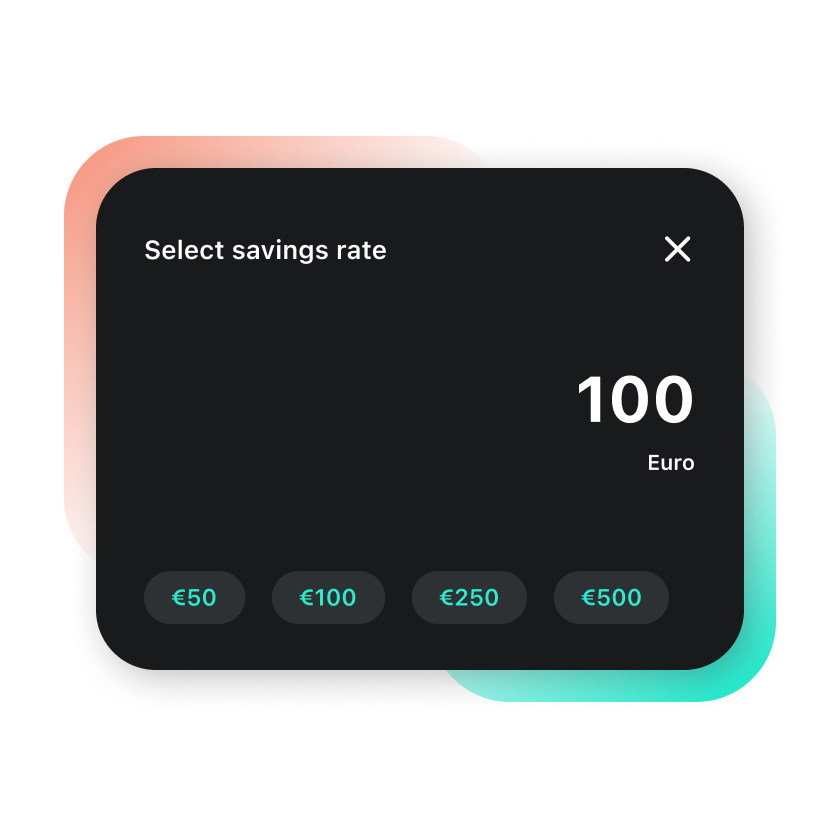

Customise your ETF savings plan with flexible savings rates, execution frequency and more.

Stay flexible

If your financial situation changes, simply adjust your savings amounts with a few clicks.

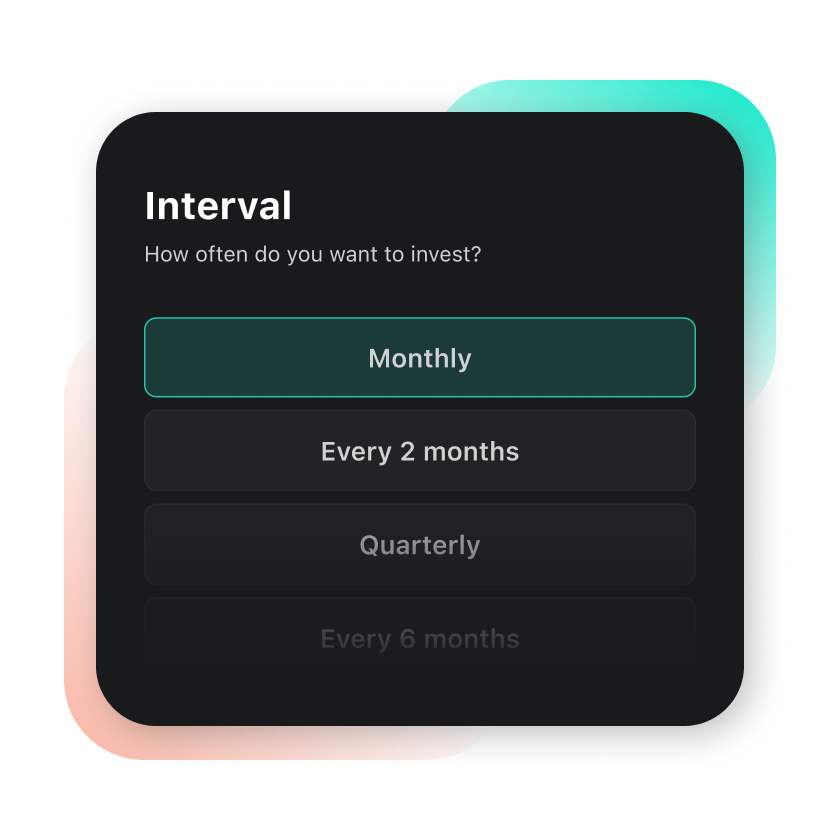

Save at your own rhythm

Savings plans can be executed monthly, bi-monthly, quarterly, semi-annually or annually on nine different days.

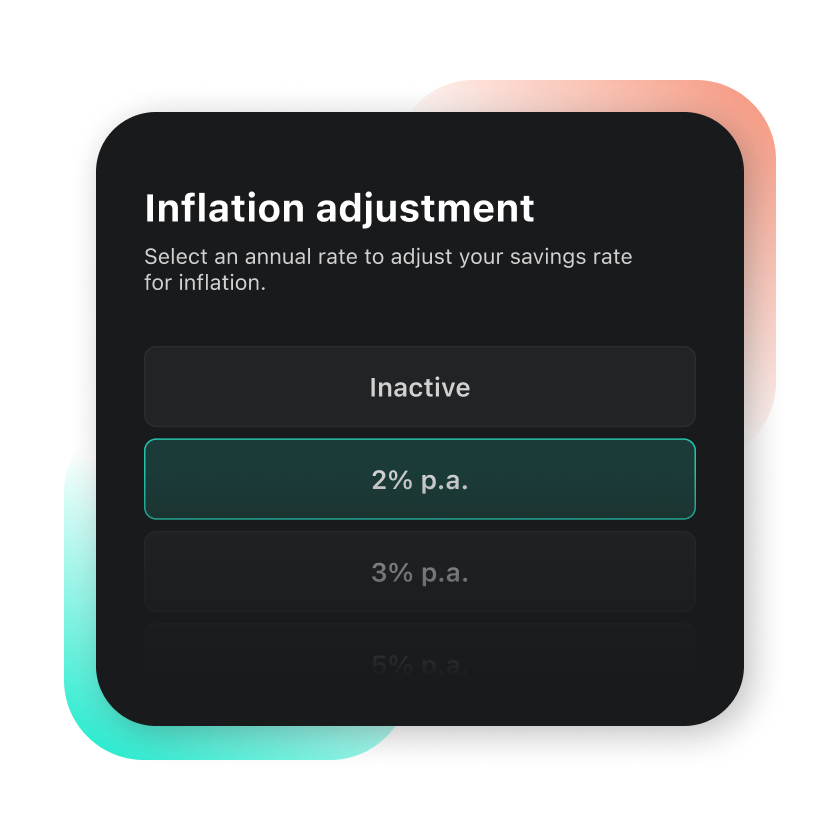

Adjust automatically

Let your savings amount increase automatically over the year by setting a dynamic inflation adjustment rate.

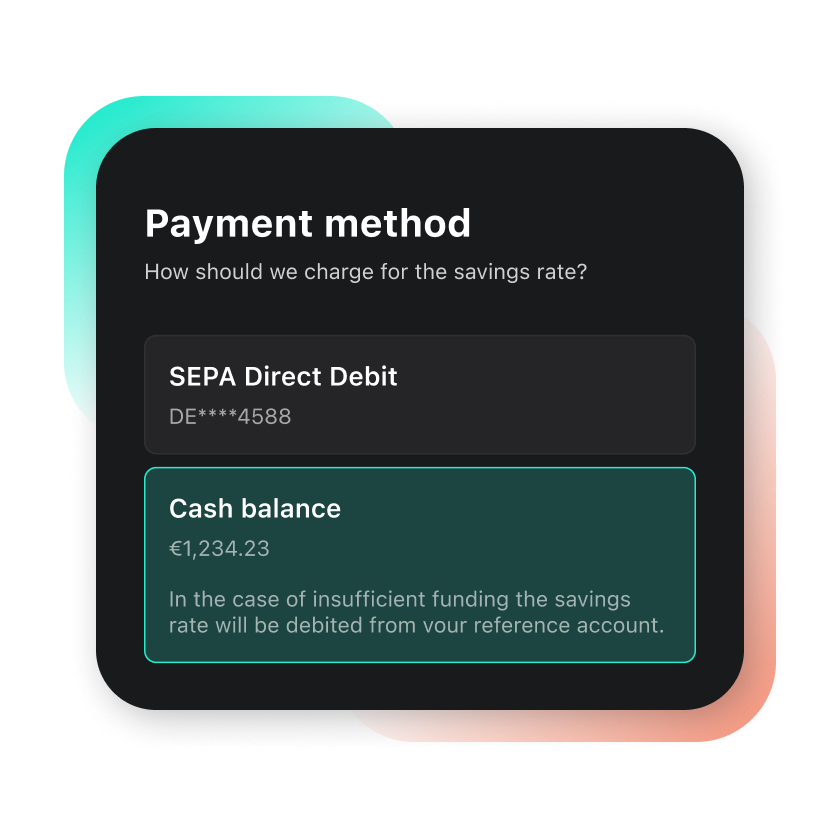

Personal deposit choice

Pay savings plan from available cash balance or by direct debit.

Save without limits

Set up unlimited savings plans from just €1

investment amount.

Popular ETFs for savings plans

Scalable MSCI AC World Xtrackers

(Acc)

ISIN |

LU2903252349 |

TER |

0.00% p.a.1 |

Xtrackers MSCI Emerging Markets UCITS ETF 1C

ISIN |

IE00BTJRMP35 |

TER |

0.18% p.a. |

1 The regular total expense ratio (TER) of 0.17% p.a. is waived until 10/12/2025. Further information can be found on the Xtrackers product page.

Set up a savings plan quickly and easily in just a few steps

Why is an ETF savings plan useful?

In this video, Nico explains the benefits of savings plans.

ETFs (Exchange Traded Funds) are investment funds that track certain stock market indices – for example the DAX. ETFs make it possible to invest broadly diversified and cost-effectively with just one investment. Learn more about ETFs in our knowledge article.

These criteria can help with the ETF selection

Finding the best index funds and putting together a portfolio from those is not exactly easy with more than 2,400 ETFs available in Europe. In this video you can find out which criteria you should pay attention to when making your selection.

Frequently asked questions

With an ETF savings plan, wealth can be gradually built up with an individually determined amount. Savings plans can be set up in the Scalable Broker from as little as €1. The installments are collected regularly and always at a certain point in time and then automatically invested in ETFs. The price of the ETF is not important for savers, since when investing the installment, fractions of ETFs are also bought if necessary. ETF savings plans continue until they are deactivated or amended.

There is no right answer as to whether an ETF savings plan is superior to a one-time investment of a larger sum or vice versa. Both are fit for different purposes. If you suddenly have a large amount of money at your disposal, in most cases it is better if you invest it in full instead of investing it in installments. A savings plan, on the other hand, is suitable for easily investing the money that you can put aside every month. Anyone who regularly invests a larger sum as a one-off investment and additionally via a savings plan takes advantage of the benefits of both investment options.