News about Scalable Capital

Digital wealth management platform and online broker Scalable Capital has been granted authorisation by the ECB to conduct deposit and lending business as a fully-fledged bank.

Financing round for Germany’s Scalable Capital values it at about €1.5bn

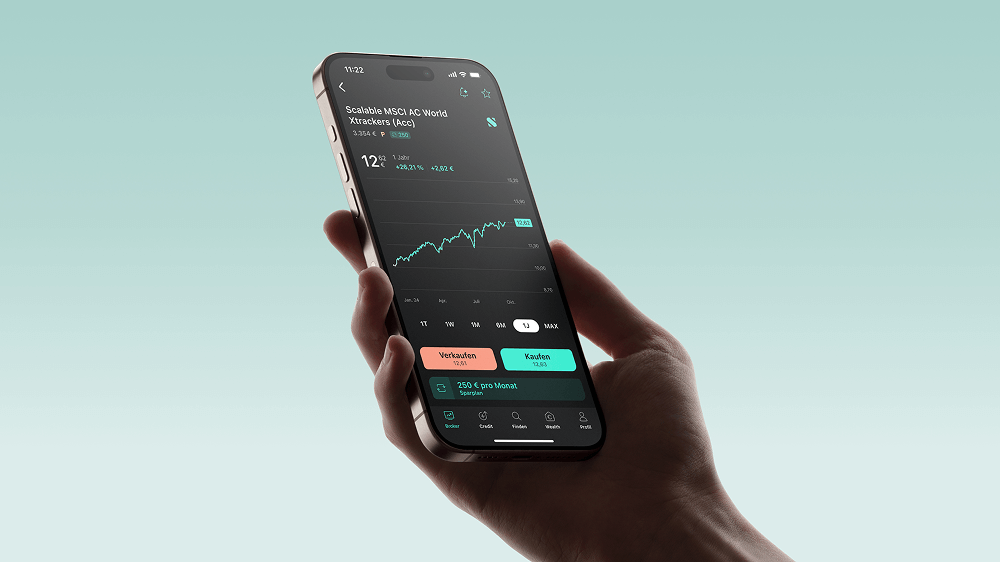

The World ETF replicates the MSCI All Country World Index and offers access to more than 2,600 large and mid-sized companies from 23 developed markets and 24 emerging markets globally in a single product.

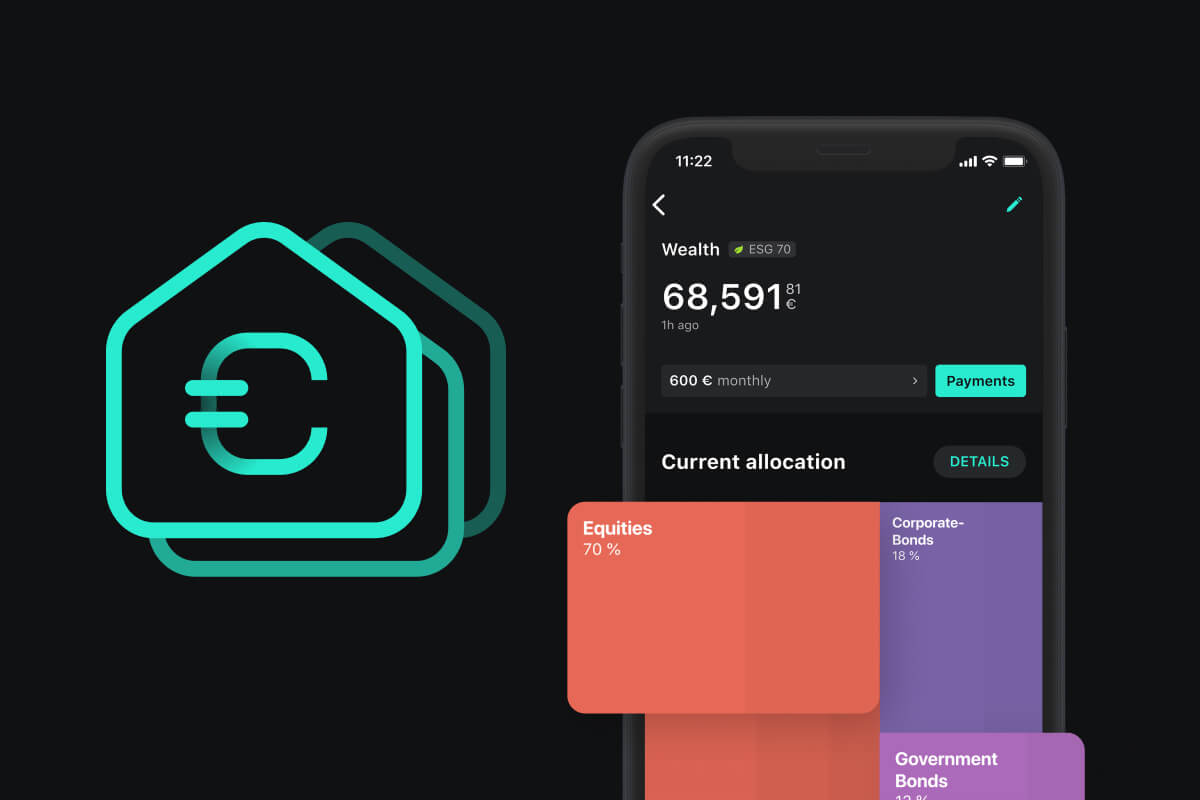

A broker, digital wealth management and loan offerings are seamlessly integrated into a newly developed technology platform. Investors can now open securities accounts directly with Scalable Capital. Clients benefit from the best conditions for trading, additional strategies in digital wealth management and a new stock exchange.

Neobroker Scalable Capital has extended its €150m Series E from June 2021 with an additional €60m raise.

The fresh funding was led by European VC Balderton Capital along with participation from HV Capital, and will be used to further grow Scalable Capital’s offering.

Scalable Capital, a Munich startup that aims to make investing in financial markets accessible to a wider range of consumers, is putting more fuel in its tank to drive deeper into Europe. The company has raised €60 million in equity ($65 million at today’s rates). It will be using the funds to build out its business in the six countries — Germany, Austria, Italy, France, Spain and Netherlands — where it is already active and to expand into more. Balderton is leading the round, with participation from HV Capital out of its new growth fund and other unnamed existing backers.

Global assets invested in ETFs are expected to grow by 50% to $15trn in just five years, with Germany among the fastest-growing countries. As a result, more Germans realise that ETF savings plans are an indispensable building block for their retirement provisions. As this boom continues, ETFs are likely to become a bigger part of investors' portfolios.

Younger investors are turning to neobrokers to open regular savings plans

The digital wealth manager is seeing “record demand” from investors for its ETF and stock savings plans.

Le Livret A ne saurait assurer à lui seul l'épargne en vue du maintien de son niveau de vie à la retraite, souligne Marc Braun. Avec un taux d'intérêt nettement inférieur à l'inflation, le rendement réel du Livret A est actuellement négatif.

Exchange traded funds, centre stage in a price war that has sharply reduced the cost of investment vehicles, appear to be playing a leading role in another revolution that is slashing the cost of investing — the proliferation of low or no-fee online platforms and apps.

Scalable Capital has become the latest neo-broker to push into cryptocurrency trading with the launch of its new product "Scalable Crypto," according to an announcement.

Germany’s digital wealth manager Scalable Capital is enjoying a boom in stock market investing in the country, driven in part by their ETF-based offering.

Scalable Capital, a German financial technology firm founded by former Goldman Sachs Group Inc. bankers and backed by BlackRock Inc., will roll out its broker app to some of Europe’s biggest non-German-speaking countries.

Horde of competing apps are betting on the "Americanisation" of European share trading after memestock frenzy.

All savings plans for stocks, ETFs and cryptocurrencies are now free of order fees as competition in the digital wealth market heats up.

Neobrokers — startups that are disrupting the investment industry by providing a platform for a wider range of consumers to partake in the stock market by offering them more incremental investment options and modern and easy mobile-based interfaces to manage their money — continue to see a huge amount of interest, and today comes the latest development in that story.

Online brokerage Scalable Capital said on Tuesday it had raised 150 million euros ($183 million) from investors led by China's Tencent (0700.HK), becoming the latest German fintech to attract sizable funding.

Negative bank rates and booming U.S. stocks like Amazon, Tesla—even GameStop—embolden investors

Scalable Capital — the Munich-based startup that has built a platform to monitor and manage investment portfolios investing in shares, manage trades and exchange traded funds for a flat fee of €2.99 per month — has closed a round of €50 million ($58 million) to expand its business.

The Economist berichtet über unsere erfolgreiche Kooperation mit ING-DiBa. In den ersten zwei Monaten der Kooperation haben bereits knapp 7.000 ING-DiBa-Kunden über 150 Millionen Euro angelegt.

Parents can now open Kids’ accounts and choose from two options: creating a portfolio themselves from ETFs, stocks, and more in Scalable Broker, or using the digital wealth management service Scalable Wealth, an all-round service handling portfolio creation, ETF selection, ongoing monitoring, and tax optimisation.

Scalable Capital has been granted authorisation by the ECB to conduct deposit and lending business. This makes Scalable Capital a CRR credit institution (full bank) supervised by the German Federal Financial Supervisory Authority (BaFin) and the Deutsche Bundesbank.

Scalable Capital is revolutionising how private investors access financial knowledge with the launch of "Insights". This innovative feature integrates specially adapted artificial intelligence directly into the platform's user interface, making Scalable Capital the first European broker to embed generative AI for real-time responses to financial and investment queries.

Scalable Capital has successfully completed a funding round, raising €155 million ($175 million). This is the company’s largest funding round to date and is led by Sofina and Noteus Partners. Existing investors Balderton Capital, Tencent, and HV Capital also participated, underlining their continued confidence in the company.

Clients at Scalable Capital can invest in Swiss stocks from Friday, May 2, 2025. Trading takes place via the European Investor Exchange and gettex as well as Xetra. After more than five years of suspension, Swiss stocks will be tradable on EU stock exchanges again.

With a new segment on its digital investment platform, Scalable Capital is setting new standards for investors: Soon, suitable investors in Germany will get access to alternative investments such as private equity. Through the Scalable Broker, they will be able to invest in companies that are not listed on stock exchanges for the first time.

Scalable Capital, a leading digital investment platform in Europe, launched their own World ETF, the Scalable MSCI AC World Xtrackers UCITS ETF (ISIN: LU2903252349), on December 20, 2024. Since then, the ETF has already surpassed 100 million euro in fund volume.

As the first digital investment platform in Germany Scalable Capital launches its own global equities core ETF, the “Scalable MSCI AC World Xtrackers UCITS ETF” (WKN: DBX1SC). Scalable Capital advises the asset manager DWS on the construction and replication of the portfolio for the new ETF.

Scalable Capital sets new standards for private investing: A broker, digital wealth management and loan offerings are seamlessly integrated into a newly developed technology platform. Investors can now open securities accounts directly with Scalable Capital. Clients benefit from the best conditions for trading, additional strategies in digital wealth management and a new stock exchange.

Christian W. Röhl will start as Chief Economist at Scalable Capital, a leading digital investment platform in Europe, on October 1st. In this newly created position the advocate for investment culture will put financial market events into context and analyse the interdependencies between the stock market, economy, geopolitics, technology, and global trends.

Scalable Capital, a leading digital investment platform in Europe, is launching a new partnership with Amundi, the largest European asset manager and leading European provider of UCITS ETFs. This partnership brings Scalable Capital clients easy access to a selection of Amundi ETFs. With more than 2,500 ETFs as savings plans or one-off investments, Scalable Capital has one of the largest ETF offerings amongst the brokers in Europe.

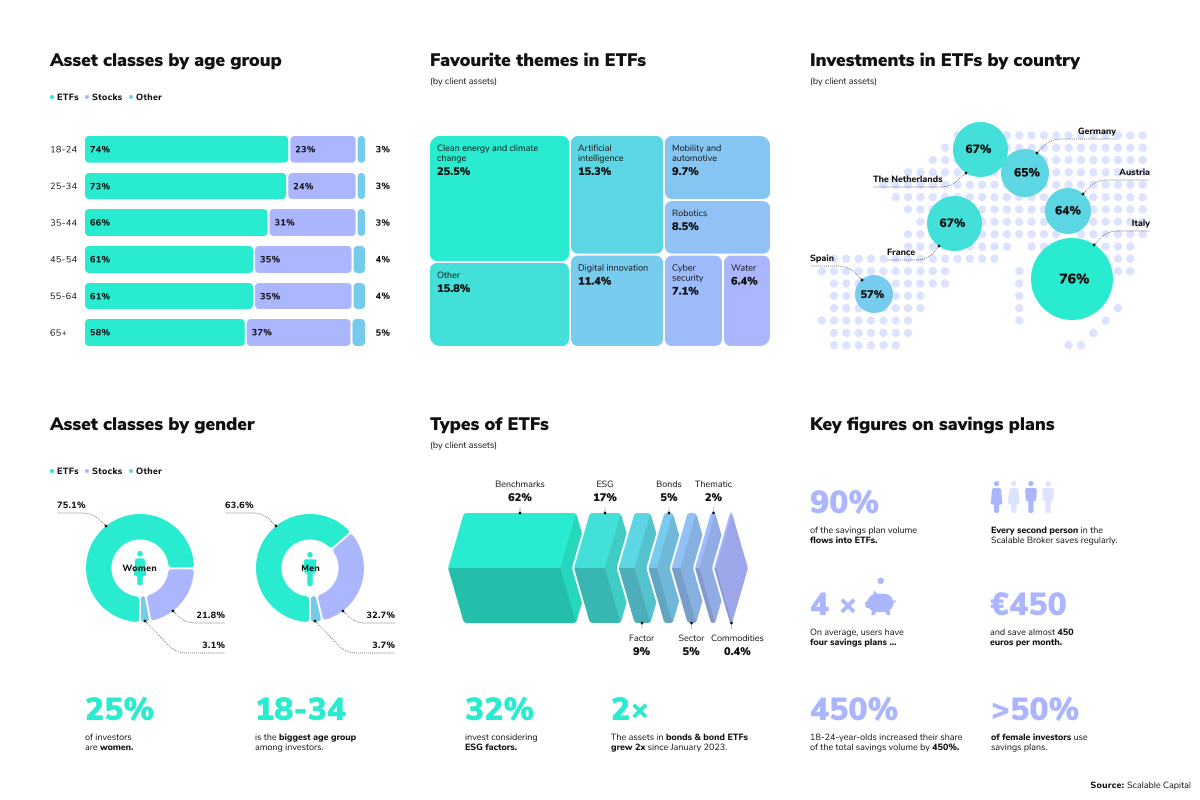

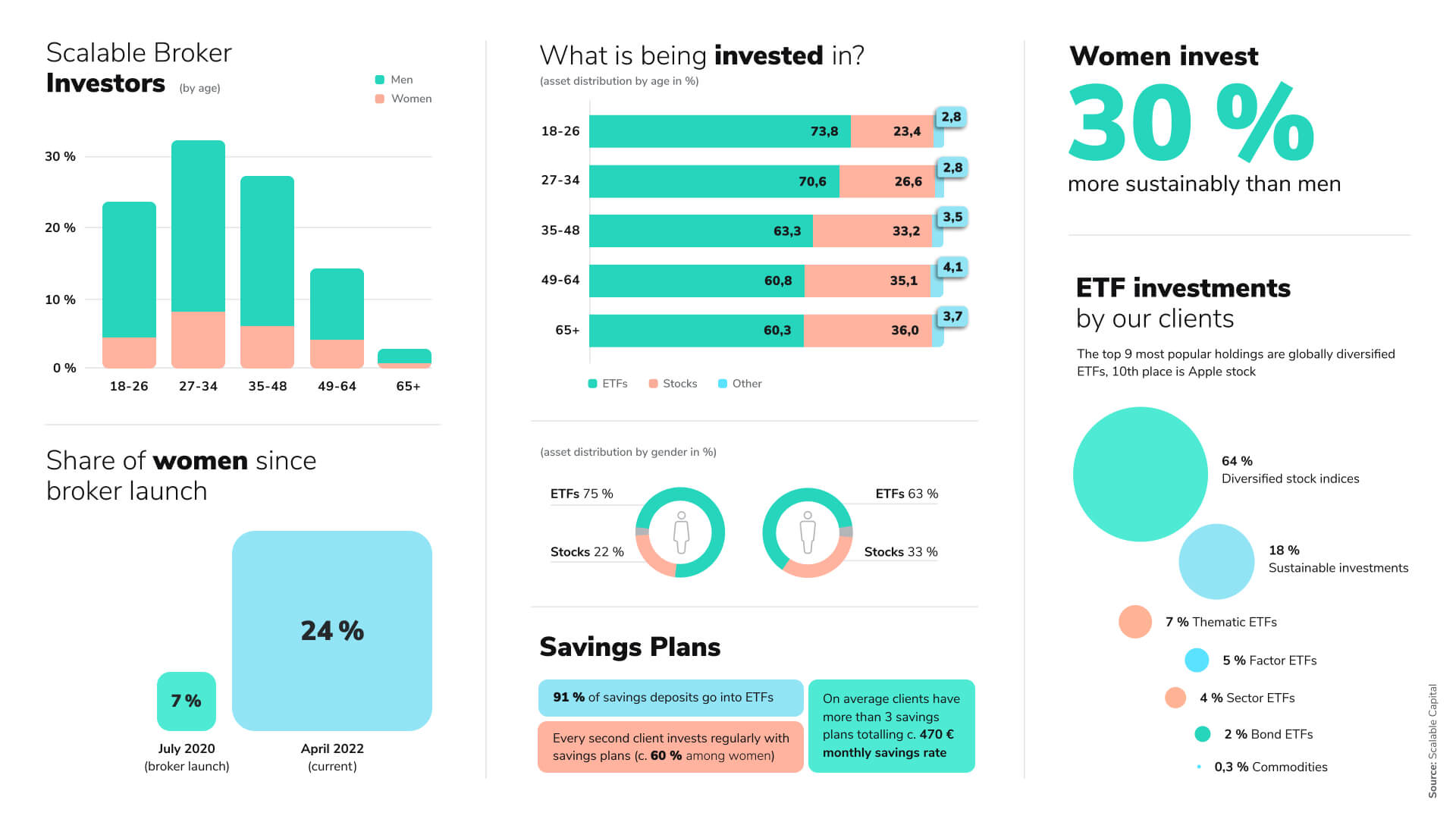

In the Scalable Broker, ETFs are favoured and savings plans are very popular; especially among the „Generation Y” (GenY). This is shown by the analysis of client behaviour from Scalable Capital, a leading digital investment platform in Europe. This is the second time that the company provides insights into the investment preferences of its clients. An analysis of investors from six European countries shows that young people in particular are leading the way in long-term wealth creation.

Scalable Capital, a leading digital investment platform in Europe, announced the closing of a 60 million euro equity financing. This extension of the series E round was led by European venture capital firm Balderton Capital.

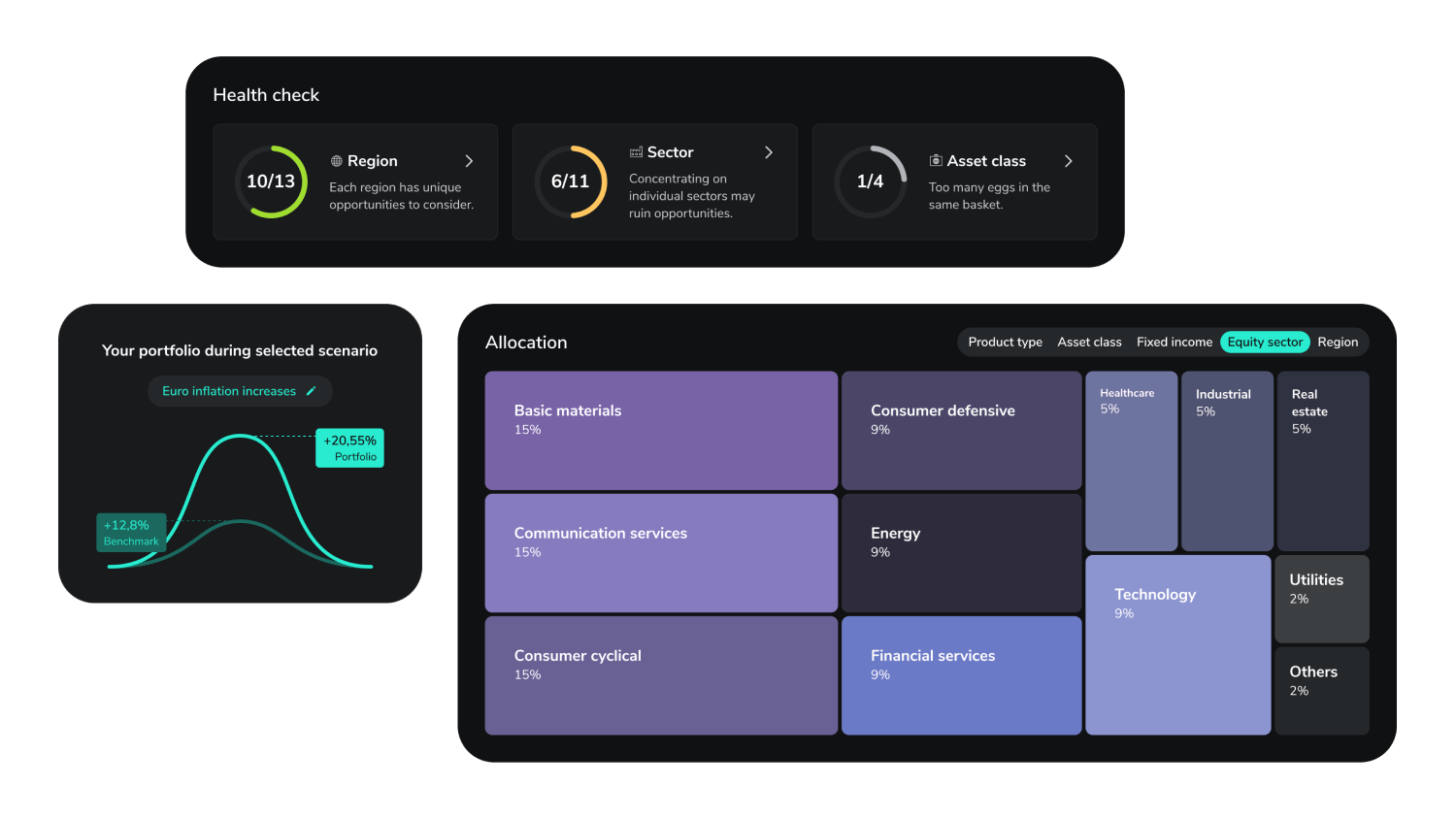

How does my portfolio cope with rising inflation? Which regions are missing? Does my portfolio face any hidden risks? - The answers to these and many other questions can be provided with “Insights”, the new portfolio analytics tool in the Scalable Broker.

Clients of Scalable Capital, a leading investment platform in Europe, now receive access to secured loans in the Scalable Broker. ‘Credit’ allows investors with permanent residence in Germany to remain financially flexible while maintaining their long-term investments in the capital markets.

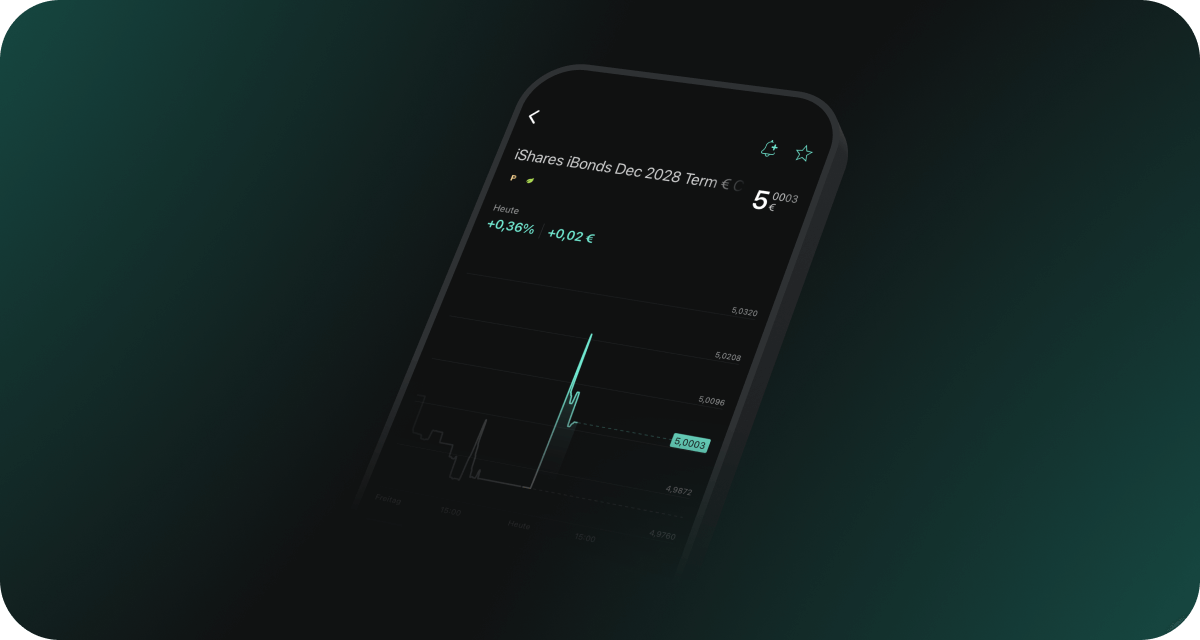

Clients of Scalable Capital, a leading investment platform in Europe, can now invest in a new form of bond ETFs. As a full service broker, Scalable Capital provides retail investors with valuable investment solutions and continues to expand its range of fixed income products. With iShares iBonds, clients are given access to a suite of products that combine the diversification, liquidity and tradability of an ETF with the fixed maturity of a bond. The issuer, BlackRock, one of the world’s leading providers of investment, advisory and risk management solutions, is rolling out iBonds in Europe for the first time. They consist of a diversified set of bonds with similar maturity dates. After a fixed period, the ETFs mature and return a final pay out to investors, in addition to regular interest payments.

Clients from Scalable Capital, a leading investment platform in Europe, will receive 2.6 % interest p.a. on cash balances of up to 100,000 euro from August 3rd, 2023. This is the highest permanent interest rate of any broker currently in the market. The offer applies to both existing and new customers of the PRIME+ broker. The variable interest rate is paid out quarterly via the partner bank (Baader Bank), until further notice, for existing and new cash balances on the cash account.

Scalable Capital, a leading investment platform in Europe, will pay 2.3 percent interest on cash balances to enable investors to benefit from the positive interest rate trend. The offer starts on February 1st and applies to both new and existing clients of PRIME+ across Europe. The price model PRIME+ combines a market leading deposit interest offer with the most affordable and best brokerage service for stocks and ETFs.

Scalable Capital, a leading investment platform in Europe, has surpassed one million savings plans. This milestone demonstrates how popular Scalable Capital’s commission-free savings plans are, and highlights their relevance for long term retirement provision.

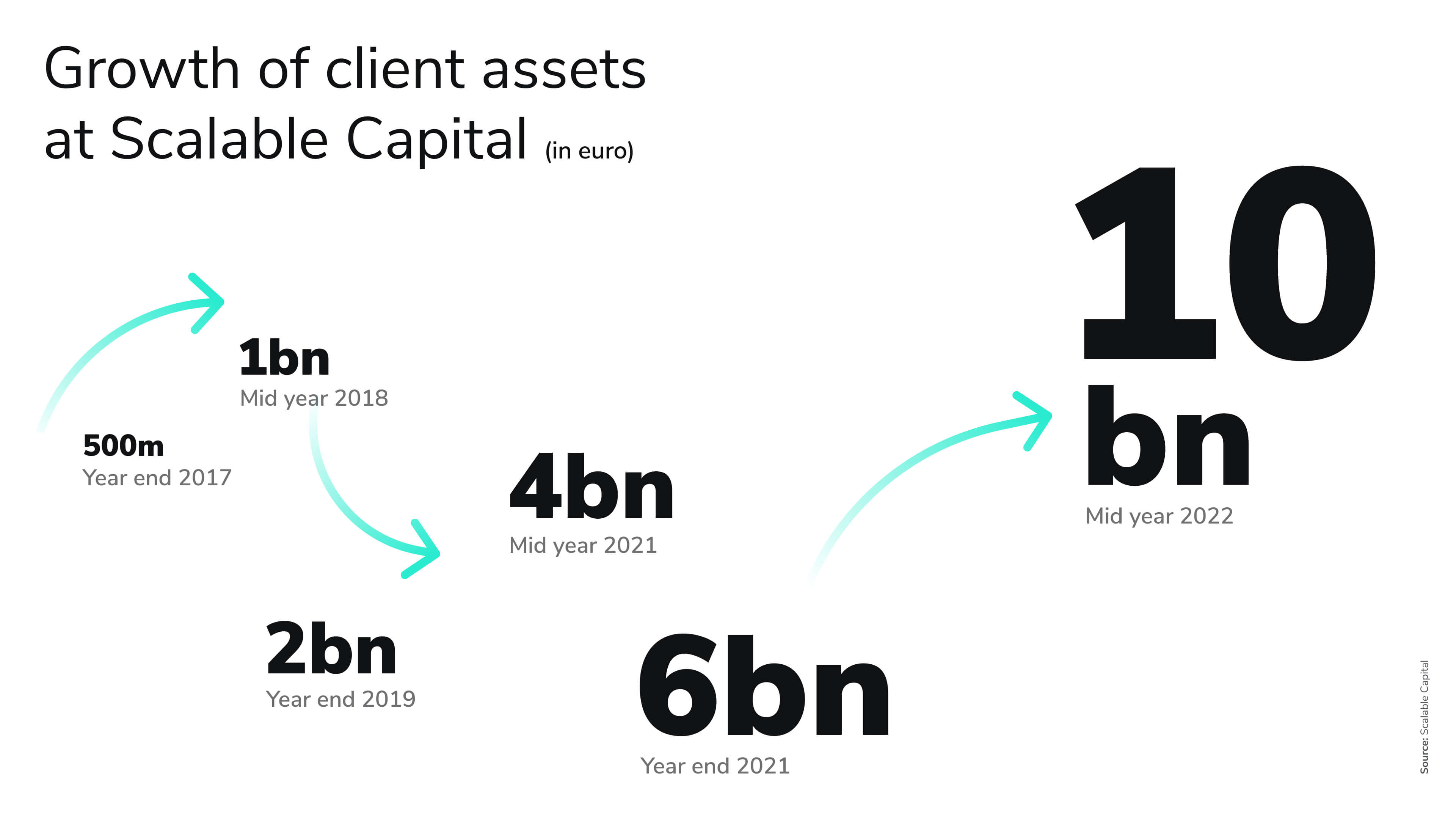

Scalable Capital has exceeded the ten-billion-euro mark in client assets. Within one year, the company has more than doubled client assets. With more than 600,000 clients on its platform, Scalable Capital is one of the leading digital investment platforms in Europe and one of the fastest growing European FinTechs.

The majority of the investors in the Scalable Broker invest in ETFs and use regular savings plans; the largest group among them is "Generation Y". This is the result of an analysis of the in-house data of Scalable Capital, one of the leading digital investment platforms in Europe. For the first time, Scalable Capital provides insights into the investment behaviour of its users and sheds light on how they invest their money and what characterises the typical investor.

Retail investors benefit financially from trading on retail exchanges that are tailored to their needs, such as gettex or Tradegate Exchange – this is the key finding of a case study by Scalable Capital, a leading digital investment platform in Europe.

Scalable Capital, the leading digital investment platform in Europe, is launching eight new investment strategies in its digital wealth management service. As of now, clients can choose from eleven different ETF-based investment approaches - including new strategies focusing on climate protection, value-investing and crypto.

Scalable Capital, a leading digital investment platform in Europe, launches its online broker and crypto offering in the Austrian market. With “Scalable Broker” and “Scalable Crypto” the company introduces convenient and cost-effective trading in more than 6,000 stocks, 1,500 exchange traded funds (ETFs), 2,000 mutual funds and 375,000 derivatives. Moreover, Austrian clients can invest in all major cryptocurrencies and set up savings plans on stocks and ETFs without commissions.

Scalable Capital, on its mission to become Europe's leading digital investment platform, expands its investment platform to Italy.

Scalable Capital, a leading fintech company in Europe, introduces Alessandro Saldutti in the role of Country Manager for Italy. Alessandro worked at the US investment bank Goldman Sachs, in their Zurich offices, managing wealth for highly affluent private clients, family offices, foundations and trusts.

Scalable Capital continues on its path to becoming Europe's leading digital investment platform. As of this week, customers in France and Spain can easily trade stocks, ETFs and cryptocurrencies, all at low cost with the Scalable Broker, as well as set up ETF, crypto and stock savings plans. Italy and Austria will follow in a few weeks.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, launches 'Scalable Crypto', a new offering for investing in crypto currencies. The offering merges seamlessly with the existing wealth management and neo-broker offerings. Via intuitive user interfaces for web and mobile, the company now offers easy, affordable and secure access to crypto investments via regulated stock exchanges in Germany. The offer is aimed at all investors who want to take their financial investment into their own hands and diversify a part of their portfolio with digital assets.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, is removing the previously required minimum investment amount of 10,000 Euros in its digital wealth management service. From November 30, 2021, every client with a savings plan will be able to invest money in digital wealth management from as little as 20 Euros per month - the initial payment previously required will no longer apply.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, expands its information services and acquires justETF GmbH, a special interest portal for exchange-traded index funds (ETFs) and investing. The founders of justETF, Dominique and Petra Riedl from Kirchentellinsfurt, as well as the team remain on board after the acquisition.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, has comprehensively expanded its savings plan offering. Clients can now regularly save towards stocks, ETFs and cryptocurrencies starting at just 1 Euro savings rate – free of order fees. With this offer, the company is taking a big step towards becoming the leading digital investment platform.

Scalable Capital, a fast-growing online broker and Europe’s largest digital wealth manager, is taking the next step on its way to become Europe's leading digital investment platform and is expanding its product portfolio within the broker to include derivatives. Clients are now able to trade certificates, warrants or other leveraged products from the cooperation partners HSBC and HypoVereinsbank onemarkets. Goldman Sachs will join as a third partner soon.

Scalable Capital, a fast growing neo-broker and Europe's largest digital wealth manager, has raised more than $180 million (€150 million) in a Series E funding round led by China’s leading technology company Tencent.

Scalable Capital, neo-broker and Europe's largest digital wealth manager, has appointed Dirk Urmoneit as Chief Strategy Officer, effective June 1, 2021. The capital markets specialist will further accelerate Scalable Capital's growth, particularly in neo-brokerage.

Contact

Ina Froehner

VP Communications & Public Affairs

+49 160 94435932

presse@scalable.capital

Marketing Requests

marketing@scalable.capital