By Dr. Christian Groll

Most people would agree that an investment should deliver a decent return over the long term, with an acceptable level of risk. However, this is often where the consensus ends. Because expectations differ as to how this goal is to be achieved. The possibilities for constructing a portfolio are too diverse, and the value concepts, investment philosophies and special wishes of investors are too varied. The different concepts and demands have their justification. Because long-term observations show again and again: There is no one portfolio that is the best for everyone and that is guaranteed to perform best in every market phase or even over the long term. That's why we at Scalable Capital are now offering more choice and expanding our portfolio of strategies in digital asset management.

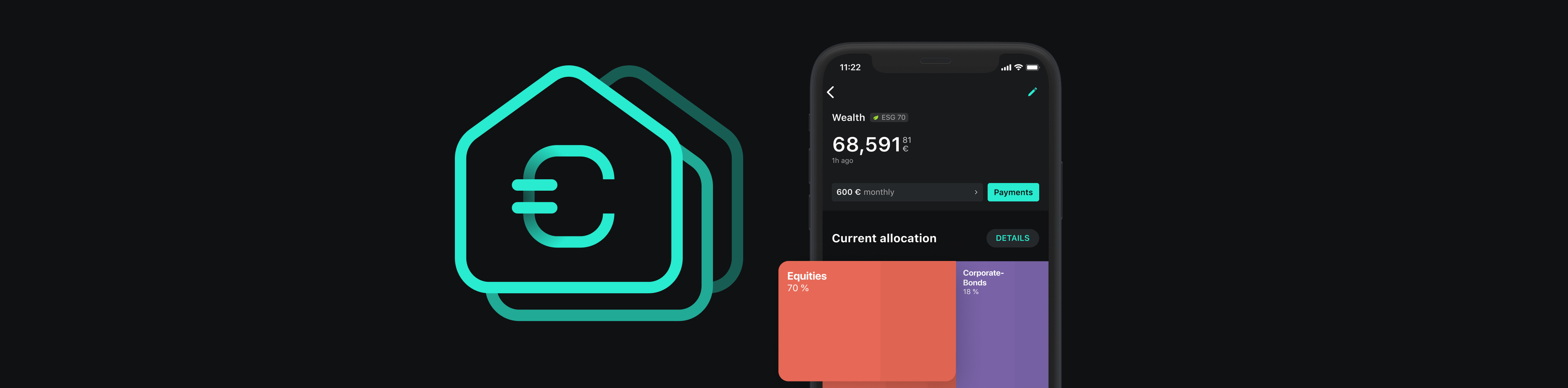

The basic principle is the same for all of them: I have a diversified portfolio put together from low-cost financial products such as ETFs or other exchange-traded products on cryptocurrencies, for example, and have it managed. Asset management not only takes care of the selection and weighting of the components, which cover different regions, sectors and asset classes depending on the approach. In the next step, it also selects the most suitable financial products for implementing the strategy, i.e., for example, the most liquid and most tax-efficient ones. It also takes on the task of monitoring the portfolio on an ongoing basis and rebalancing it if necessary. This rebalancing, which, depending on the concept, becomes necessary in the event of certain deviations from a target weighting or, for example, in the event of risk changes on the market, would only be possible with a great deal of effort on my own.

The basic mix: stocks, bonds - and maybe a little more

A broadly diversified portfolio, which should meet the requirements of many, can be created from the basic ingredients of stocks and bonds. A broadly diversified basket of equities serves as a yield building block, while ETFs on corporate and government bonds act as a stabilizing element. The portfolios of the Scalable Wealth strategies are structured according to this principle. Because people can tolerate different amounts of risk, the ratio between the two asset classes can be defined in ten-percent increments: a high proportion of equities (up to 100 percent) can mean greater fluctuations in value, but also higher potential returns. If you are more risk-averse, you will give bonds a higher weighting.

The equity quota determines the risk category

Target weighting of an ESG 70 portfolio

One feature of the portfolios is that they are inherently sustainable. This means they already meet a criterion that is becoming increasingly relevant in the financial world. In some cases, investors already take sustainability for granted when investing. All equity ETFs in the Scalable Wealth portfolios comply with the SRI standard. The abbreviation stands for "Socially Responsible Investing", the strictest set of criteria of index provider MSCI for sustainable indices and ETFs.

For additional diversification, alternative asset classes such as gold and commodities are an established building block. That's why we offer the Wealth portfolios with an optional addition of gold, a precious metal that has been established as a means of payment and store of value for thousands of years, and a commodity ETF that tracks the price development of oil and gas, for example.

Broadly positioned with gold and commodities

Target weighting of a portfolio in the risk category ESG 70 Gold

Wealth Select: value, allweather or megatrends? Anything is possible!

The easy-to-understand wealth strategies can be described as portfolios that could be the right choice for broad strata. At this point, the story could therefore be finished, were it not for the fact that, as mentioned at the beginning, there are other sensible portfolio concepts, each with its own strengths. Some of them fulfill special requirements, such as getting through all market phases with as little fluctuation as possible, or allow special market views to be expressed. With the Wealth Select strategies, Scalable Capital now offers a broad spectrum of complementary portfolios. From now on, those who want to invest will have even more options to meet individual requirements. All Wealth Select portfolios are available for our clients with a custody account at Baader Bank, most of them also with a custody account at ING:

- Climate protection

- Value

- GDP Global

- Allweather

- Dynamic Risk Management

- Megatrends*

*This investment strategy is currently not available to customers with custody accounts at ING.

The ideas behind these strategies differ greatly. And in some cases, the composition of the portfolios deviates significantly from market-wide approaches, which are often based primarily on standard indices or a weighting according to stock market value. Therefore, it is also to be expected that the performance over several years can deviate significantly from that of well-known market barometers such as the S&P 500, MSCI World or even the DAX - for better or worse.

Why such different approaches? Three examples illustrate how portfolios meet different expectations with which people approach investing.

For many, climate protection is now a key issue that is also a focus when it comes to investing: Their money should only be invested in companies that are particularly well positioned in the fight against global warming. Such companies form the focus of the climate protection portfolio, which has a choice of 60, 80 or 100 percent equity exposure. With one exception, the equity ETFs in the portfolio are based on so-called "Paris-Aligned" indices. These are benchmarks whose composition focuses on the 1.5-degree target of the Paris climate conference. In addition, a thematic ETF for clean energy is included.

Committed to the 1.5-degree Paris target

Investment universe of the climate protection portfolio

Asset class |

Financial product |

|---|---|

Equities USA |

iShares S&P 500 Paris Aligned UCITS ETF |

Equities Europe |

iShares MSCI Europe Paris-Aligned Climate UCITS ETF |

Equities Emerging Markets |

HSBC MSCI Emerging Markets Climate PAB UCITS ETF |

Equities Japan |

HSBC MSCI Japan Climate Paris Aligned UCITS ETF |

Equities Pacific area |

iShares MSCI Pacific ex-Japan ESG Enhanced UCITS ETF |

Equities global |

L&G Clean Energy UCITS ETF |

Bonds global |

Lyxor Green Bond UCITS ETF - Monthly EUR Hedged |

Compared to a standard ETF on, for example, the US equity market, many companies are excluded from the Paris Aligned ETFs. For those that remain, simply put, the weighting in the ETF is shifted in favor of those that emit the least climate-damaging gases. As a result, the equity ETFs and also the portfolio as a whole deviate significantly from an investment composed according to the widespread principle of market capitalization. The focus on climate protection also sets the portfolio apart from our wealth portfolios, which are based on a broader approach to sustainability.

Investing like Warren Buffett with a rules-based approach

The value portfolio, for example, takes a completely different approach. Warren Buffett, the best-known living representative of value investing, makes a very active and individual stock selection. However, the basic idea of value investing can also be translated into a rule-based concept. This is what happened with our strategy: It relies on value factor ETFs. The approach of investing in low or undervalued companies is systematized in these financial products and in the portfolio as a whole. The ETFs in the 100 percent equity portfolio contain the securities of companies that have a low price/earnings ratio, for example. By systematizing and automating Buffett's approach using ETFs, value investing can be applied to thousands of companies. You don't have to pick out individual companies, but invest very broadly according to the value principle.

Scientific studies have shown that a stock selection based on the value factor can, under certain circumstances, generate an excess return compared with a broad market portfolio. There is no guarantee that the expectation will be fulfilled in every market phase. The value concept is a typical example of a portfolio that can lag behind the broad market during boom phases. However, when corrections occur, especially in highly valued stocks, such a portfolio can show its strengths.

USA and Europe on a par

Target weighting of a value portfolio

Once again, the Megatrends portfolio embodies a completely different approach. The composition is discretionary in the best sense. That is, it neither follows certain value concepts, nor is it rule-based, but is based on an individual assessment. In this case, that of our investment team: seven overarching themes could significantly shape the world in the coming years. Each is equally represented by an equity ETF in the current portfolio lineup: artificial intelligence, battery technology, biotechnology, blockchain, cybersecurity, renewable energy and robotics. An approach for those expecting a boom in these technology fields.

Value-based, rule-based or discretionary: the three portfolios described exemplify different fundamental ideas with which people approach investing. With our Wealth Select strategies, it is now possible to implement very different investment ideas. The goal of building wealth over the long term can basically be achieved with any of the strategies. However, the portfolios may behave very differently in terms of performance and fluctuations over the course of an investor's life over ten, 20 or even more years.

It is up to each individual to decide which portfolio to choose, whatever his or her thoughts may be. It does not have to be either/or. I can, for example, be convinced of value investing and at the same time wish to have part of my money in an allweather portfolio that is more likely to get through all phases of the stock market with little fluctuation. In that case, I can open several portfolios and run them in parallel. After all, monitoring and rebalancing them is what asset management takes care of.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.