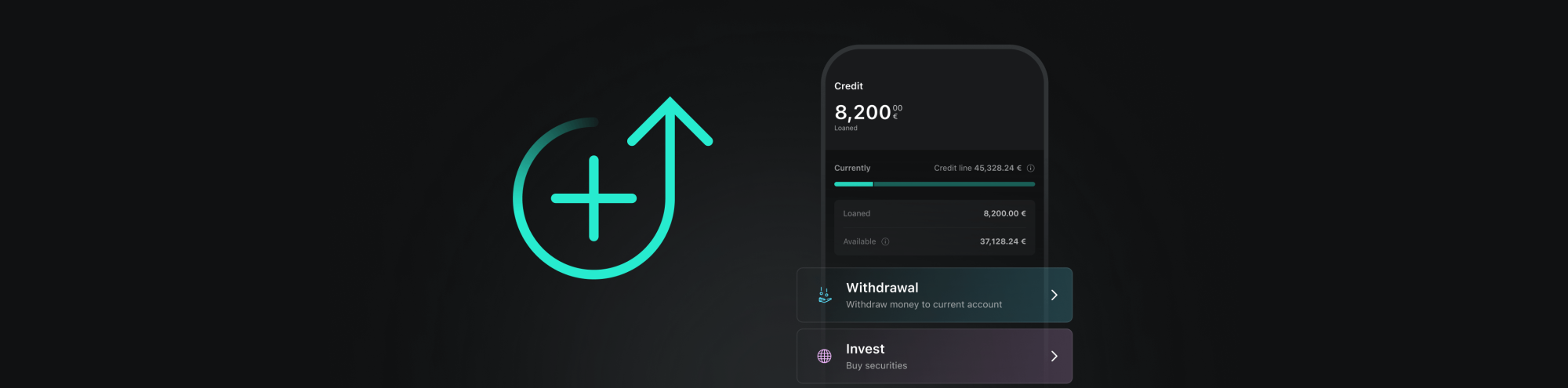

At Scalable, users now have access to Credit, a secured loans offering1 in the Scalable Broker. What is it about?

A secured loan, like Credit in the Scalable Broker, offers investors the possibility to take out a loan based on their securities. The securities, for example stocks, ETFs and funds, serve as collateral for the lender - in the case of Credit, this is our partner bank Baader Bank. The amount of the credit depends on the type and value of the deposited securities. Credit can be used very flexibly, whether to raise liquidity or to invest, for example to take advantage of short-term market opportunities or to further diversify a portfolio.

Advantages

- Quick and easy. You can apply for the loan conveniently online. Usually, you receive feedback within a short time. Since your own securities serve as collateral, you do not need to provide any other proof, such as a Schufa report, which is usually required for other types of credit.

- Fair. Interest2 is only due if the loan is used. The borrowed amount can be repaid at any time free of charge and without having to adhere to a fixed term.

- Flexible. The loan amount can be used in a variety of ways, whether for investment or other purposes.

Risks

- The interest rate is variable and increases if market interest rates rise.

- If the credit line is overdrawn (e.g. due to a loss in value of the collateral), the credit must be reduced by paying in or selling securities. This may be associated with price losses (incl. total loss).

- Additional costs may be incurred if the credit line or credit facility is overdrawn through interest for the tolerated overdraft and/or default interest. The bank may terminate the deposit and demand immediate repayment in full.

Example

You have securities worth €10,000 in your Scalable Broker account. Securities cannot be lent on in full. Your credit line based on your securities amounts to €5,000 in this example. Of this amount, you use a credit of €2,000 for 3 months.

Credit line |

€5,000 |

Amount of credit used |

€2,000 |

Duration |

90 days (3 months) |

Interest calculation method |

act/360 |

Sample variable borrowing rate (p.a.) |

6.67% (3-month Euribor® + 3%) |

Interest rate |

€33.35 |

Total amount owed |

€2,033.35 (€2,000.00 + €33.35) |

Use credit intraday even free of charge

You have a lot of experience in investing and need the necessary liquidity intraday for trading? You can also use your existing securities account and borrow against the securities it contains. If you pay back the borrowed amount on the same day, you can even use Credit free of charge. Please note that the final withholding tax is withheld on the sale of securities at a profit. You should therefore take into account any taxes3 that may be due. Also take into account the special risks of same-day transactions.

In summary, credit is particularly suitable for short to medium-term financing. The main advantages are the quick application and the flexibility in use and repayment. However, Credit is also associated with risks of which you should be aware.

1Be aware of the risks of credit-financed investments. Credit offer of Baader Bank AG, Weihenstephaner Str. 4, 85716 Unterschleissheim, mediated by Scalable Capital. Only available in connection with a Scalable Broker account and up to €100,000.

2Quarterly interest only if used: 3-month Euribor® + 3% p.a. (5.05% p.a. variable interest rate, as of January 2026).

3Scalable Capital does not provide tax advice. Please consult your tax advisor if you have any questions.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.