WEALTHSELECT

Full focus on

performance

Invest globally in portfolios weighted by gross

domestic product

When investing, your capital is at risk. Learn more about risk here.

GDP Global investment strategy

With this investment strategy, you invest in a global equity portfolio. Unlike most other strategies, the composition is not based on market capitalization, but on real economic performance: companies from countries with higher gross domestic product (GDP) have a larger share than companies from countries with lower economic performance. This ensures that the economic performance of a region is decisive for its representation in the portfolio.

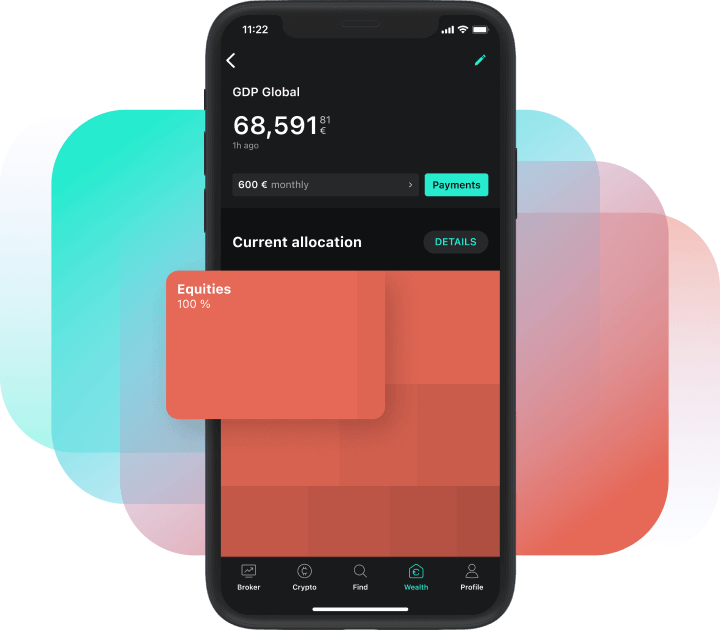

Portfolio allocation

The investment strategy involves investing exclusively in equities (100% equity ratio). As a result, both return opportunities and risk are increased.

Performance at a glance

Note: Past performance is not a reliable indicator of future performance.

Current investment universe

Asset class | Financial Product | Weight |

|---|---|---|

Equities / US | iShares S&P 500 Swap UCITS ETF | 29.2% |

Equities / Canada | UBS MSCI Canada UCITS ETF | 2.3% |

Equities / Europe ex-UK | Vanguard FTSE Developed Europe ex UK UCITS ETF | 17.5% |

Equities / Germany | Xtrackers DAX UCITS ETF | 1.6% |

Equities / UK | iShares Core FTSE 100 UCITS ETF | 3.6% |

Equities / Japan | Amundi Prime Japan UCITS ETF | 4.5% |

Equities / Pacific ex-JP | L&G Asia Pacific ex Japan Equity UCITS ETF | 3.2% |

Equities / EM | iShares Core MSCI Emerging Markets IMI UCITS ETF | 21.3% |

Equities / Latin America | Amundi EM Latin America UCITS ETF | 3.1 % |

Equities / China | Xtrackers CSI 300 Swap UCITS ETF | 13.7% |

The costs at a glance

Let us manage your assets. Transparent and inexpensive. Learn more about our costs.

Calculate your costs

Portfolio value

€20Total costs per year

Administration & trading

ETF costs (TER)

Total

When calculating the total annual costs, the individual fee levels are taken into account.

Status of product costs: December 2024