Scalable Wealth

Taxes: Automatic, smart, optimised.

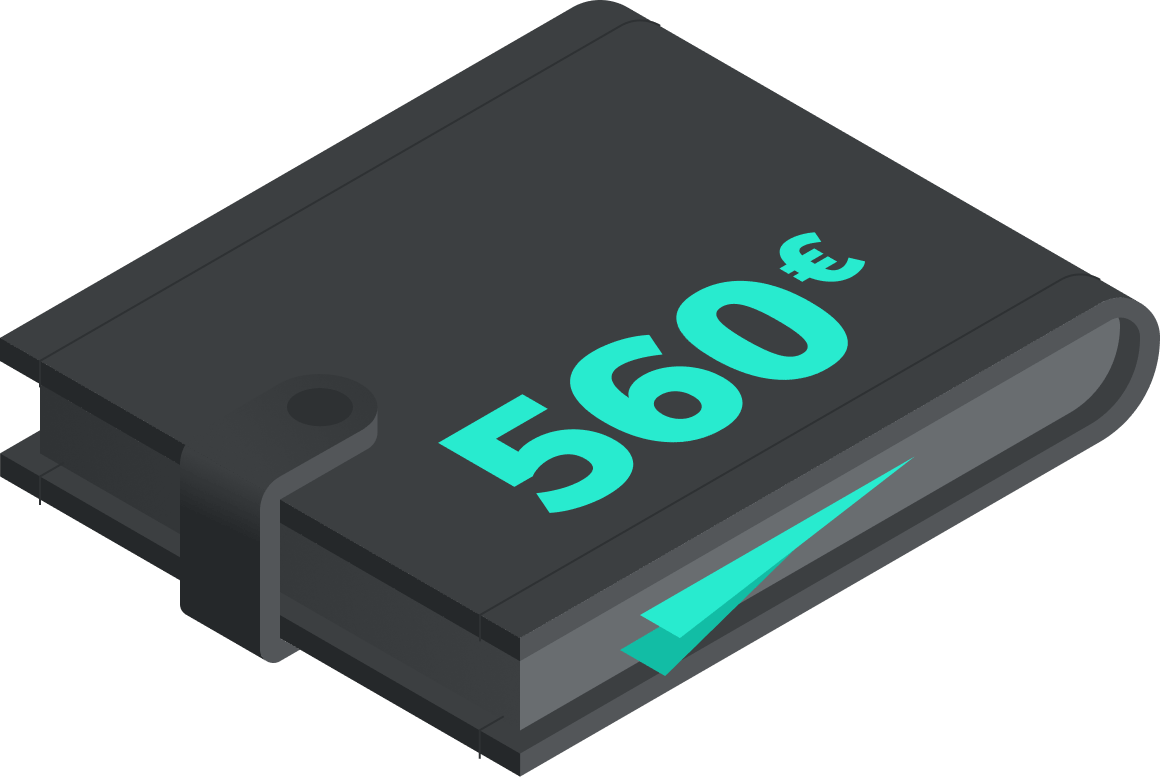

Save up to €560* yearly - without any effort

- Our investment technology helps to optimally utilise the exemption order issued

- Individual tax criteria are taken into account when making investment decisions

- Selection of ETFs with favourable tax characteristics

*Calculation assuming an exemption order of €2,000, capital gains tax of 25%, solidarity surcharge of 5.5% and church tax of 9%.

Make the most of your exemption order in Scalable Wealth: save up to €560.

Utilising your tax free allowance enables you to be exempt from paying tax on capital income up to an annual amount of €1,000 (for single taxpayers) or €2,000 (for jointly taxed persons).

If you issue an exemption order, the Scalable Capital will not deduct the withholding tax otherwise due on investment income until the saver's lump sum is reached. This means that there is no unnecessary tax burden. It is not possible to carry forward unused exemption allowances to the following year, but exemption orders can be adjusted at any time during the year. You can view any established exemption orders in the customer area.

This is how we maximise the benefit of your exemption orders

Our investment technology takes into account your transaction history in order to determine your investment gains, any outstanding distributions and, if applicable, any other portfolios you have. For each portfolio, we optimise the relationship between the potential tax savings and the costs of the potential transactions which would arise from the bid-ask spread. If the optimised utilisation of the tax free allowance is relevant for your portfolio, you will be informed by us and can decide for yourself whether the optimisation should be carried out.

**Assumption: capital gains tax: 25%, solidarity surcharge: 5.5%; church tax: 9%.

This is how your individual tax situation is evaluated against potential transactions

Anyone who is liable for tax in Germany and earns capital income must pay withholding tax. Capital income arises, for example, from distributions or the sale of ETFs at a profit. The final withholding tax is 25 per cent. The solidarity surcharge and, if applicable, church tax are added to this. The maximum tax burden thus rises to just under 28 per cent. The tax is withheld directly by Scalable Capital.

Estimating the tax effect of transactions is a central component of our investment technology. The withholding tax retained by Scalable Capital on the sale of ETFs with tax-relevant gains immediately reduces the liquidity available for subsequent purchase transactions, for example in the case of rebalancing. Our tax calculation ensures that the necessary liquidity is available for same-day rebalancing in your portfolio.

The advantage: your money does not sit in the clearing account overnight without earning interest, but is immediately reinvested in the best possible way for you.

Tax efficient ETF product selection

Depending on the domicile of the ETF and the geographical focus of the index being tracked, there are different tax burdens at a fund level due to withholding tax and existing double taxation agreements. In this regard, we favour ETFs with a favourable domicile for you.

Since the investment tax reform, accumulated income within ETFs is no longer taxed on an ongoing basis as income equivalent to distributions. Instead, there is a simplified flat-rate taxation through an annual advance lump sum. This is based on the Bundesbank's base rate (long-term achievable yield on public-sector bonds) and is also limited to the ETF's capital growth in the calendar year. As public bonds have lower yields compared to other asset classes (e.g. shares or corporate bonds) and income is only taxed in years with an increase in value, and part of the tax burden for current income is shifted to the future. Compared to "distributing" ETFs, more capital remains in "accumulating" ETFs and can work for you.

Certain domestic income is already taxed in the ETF. In order to avoid double taxation, part of the income is exempt from taxation at custody account level (partial exemption). The partial exemption rate depends on quotas for certain asset classes in the ETF. Depending on the asset class and weighting in the ETF, the partial exemption for the investor therefore varies. Commodity ETFs in particular, which are collateralised with other asset classes, can benefit from this.

Learn more about our ETF universe.

Frequently asked questions about taxes

Can I benefit from tax optimisation if I use Scalable Capital's wealth management and broker?

If you use both automated wealth management and the broker, your exemption order will be taken into account across both products. In this case, this means that you only need to submit one exemption order so that it can be optimally utilised across both products.

An example: If your exemption order for €1,000 was not fully utilised towards the end of the year, this is automatically taken into account by our investment technology and the portfolio is tax-optimised in your favour. You can find details on this in the section "Make the most of your exemption order: save up to €560."

How are taxes taken into account for payouts?

In order to realise your desired payout amount after tax, we calculate the tax implications in advance and sell securities accordingly.

How can I change my exemption order?

To change your exemption order, please log in to your personal customer area on our website and open the "Profile" menu. You can set up or change your exemption order in the "Taxes" section.

The exemption order applies at a bank level. For example, if you have a Wealth Management with custody account management at Scalable Capital, the exemption order set up for this also applies to your Scalable Broker account.

I don't want to use tax optimisation. How can I unsubscribe?

We will inform you if optimised utilisation of your tax free allowance is relevant for your portfolio. You can then decide whether the optimisation should be carried out.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.