Empowering retail investors - typical client behaviour in the Scalable Broker shows that people are investing in the capital markets long term for their retirement

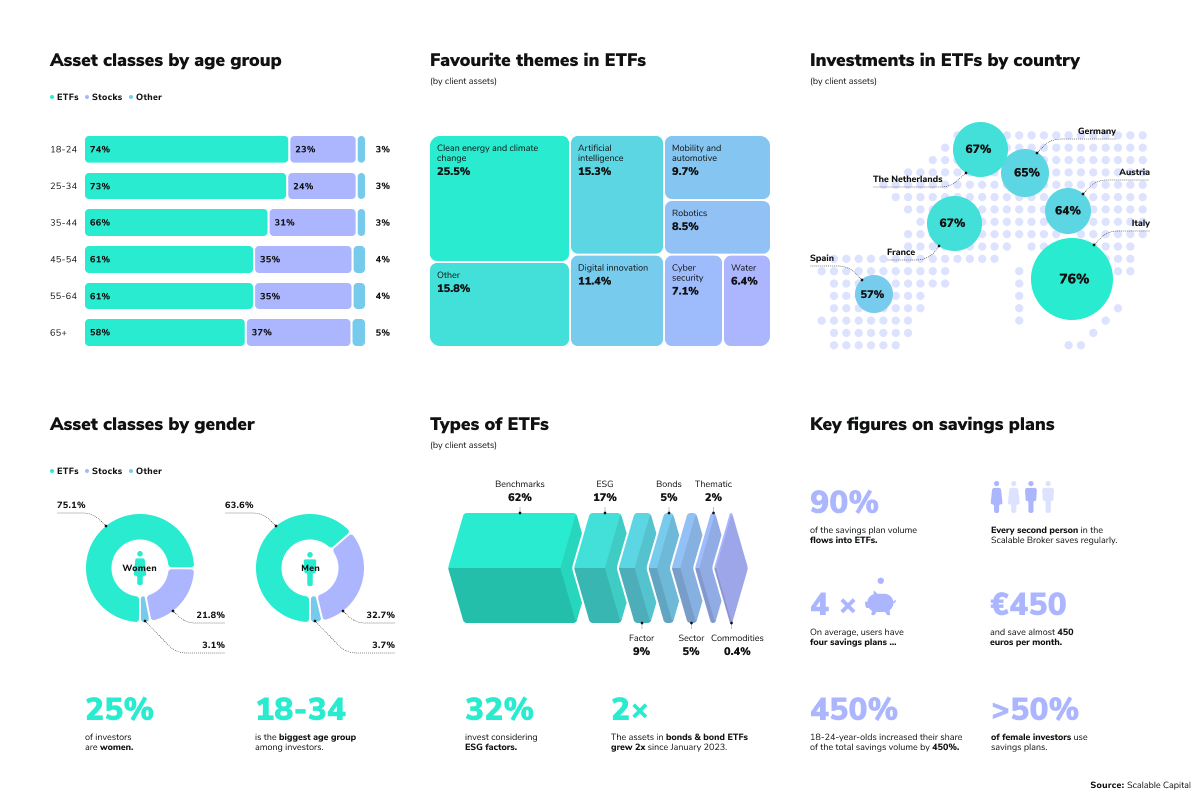

Munich, 14.12.2023 In the Scalable Broker, ETFs are favoured and savings plans are very popular; especially among the „Generation Y” (GenY). This is shown by the analysis of client behaviour from Scalable Capital, a leading digital investment platform in Europe. This is the second time that the company provides insights into the investment preferences of its clients. An analysis of investors from six European countries shows that young people, in particular, are leading the way in long-term wealth creation

"Instead of gambling, our clients invest over the long term with savings plans. Global ETFs remain the most popular choice, and recently there has been increased diversification with a rise in interest rate investments to reduce risks. The younger the client, the more textbook the investor," says Erik Podzuweit, founder and Co-CEO of Scalable Capital, explaining a central key finding.

Responsible investing continues to gain in importance among young people and women: "Investments based on environmental, social and ethical criteria are particularly common in the portfolios of GenZ and women. Almost a third of our customers have ESG investments," says Erik Podzuweit. In the first half of 2023, portfolios at Scalable Capital accounted for almost one percent of all global net inflows into ESG products - i.e. including money from large insurers, funds, and other professional investors1.

1This is based on figures from the STOXX Quarterly ETF Intelligence Insights Report.

The need to privately provide for retirement exists throughout Europe. Nevertheless, investment behaviour of the clients differs in the various European countries. For example, the analysis of clients shows that in Italy, proportionately more is invested in ETFs compared to other forms of investment than in Spain.

Looking at the currently discussed regulation in the retail investment strategy at EU level, one thing becomes clear: "Our data shows that brokers like Scalable Capital enable retail investors to participate in the capital market. They use this primarily for long-term pension provision. However, this is only made possible by commission-free saving and investing at low order fees," the CEO continues.

The most significant results of the analysis:

Low-cost ETFs are the clear favourite among asset classes

2compare ESMA, Performance and Costs of EU Retail Investment Products, 2022.

Long-term investing is in vogue; female investors invest most responsibly

Increased interest in bonds and interest rates

Trending topics: Clean energy and climate change before AI

A look at other EU countries: What can Germany learn from its neighbours?

Generation Z (GenZ) and women are catching up

About Scalable Capital

Scalable Capital is a leading digital investment platform in Europe that makes investing easy and affordable for everyone. Clients of the Scalable Broker can trade 8,000 stocks, 2,500 ETFs, and 3,500 funds and other exchange traded products to build their portfolios, earn interest on their cash balance and take secured loans. The PRIME subscription enables unlimited trading on all orders over 250 euro. Clients in PRIME+ receive up to 4 % p.a. on uninvested cash up to 1 million euro. People can also have their investments professionally managed via the digital wealth management service. Scalable Capital was founded in 2014 and is active in Germany, Austria, France, Italy, the Netherlands, Spain, and the UK. The investment firm, which is supervised by BaFin and the Bundesbank, has more than 16 billion euro on its platform. In addition to its business for private clients, the company operates B2B solutions. Its long-standing partners include ING, Barclays Bank in the UK, the robo-advisor Oskar, and the Santander Group in Spain. Scalable Capital employs more than 450 people at its offices in Munich, Berlin, and London. Together with the founding and management team around Erik Podzuweit and Florian Prucker, they strive to empower everyone to become an investor. More information at: www.scalable.capital

Media contact

Ina Froehner

Scalable Capital

VP Communications and Public Affairs

+49.160.94.43.59.32

press@scalable.capital