Foreign Exchange at Scalable Capital

Trading currencies made easy

Invest in the global currency market with a wide selection of currency ETPs in the Scalable Broker.

Investing involves risks.

What is Foreign Exchange?

Foreign Exchange, also known as Forex or FX, is the exchange of one currency for another.

It is the largest and most liquid market in the world.

Trading currencies - this is how it works

Especially the common currencies are often exchanged against each other - these include the Euro, US Dollar and Japanese Yen. In the Scalable Broker you can trade these and other currencies easily in three steps:

Expand your portfolio with global currency ETPs

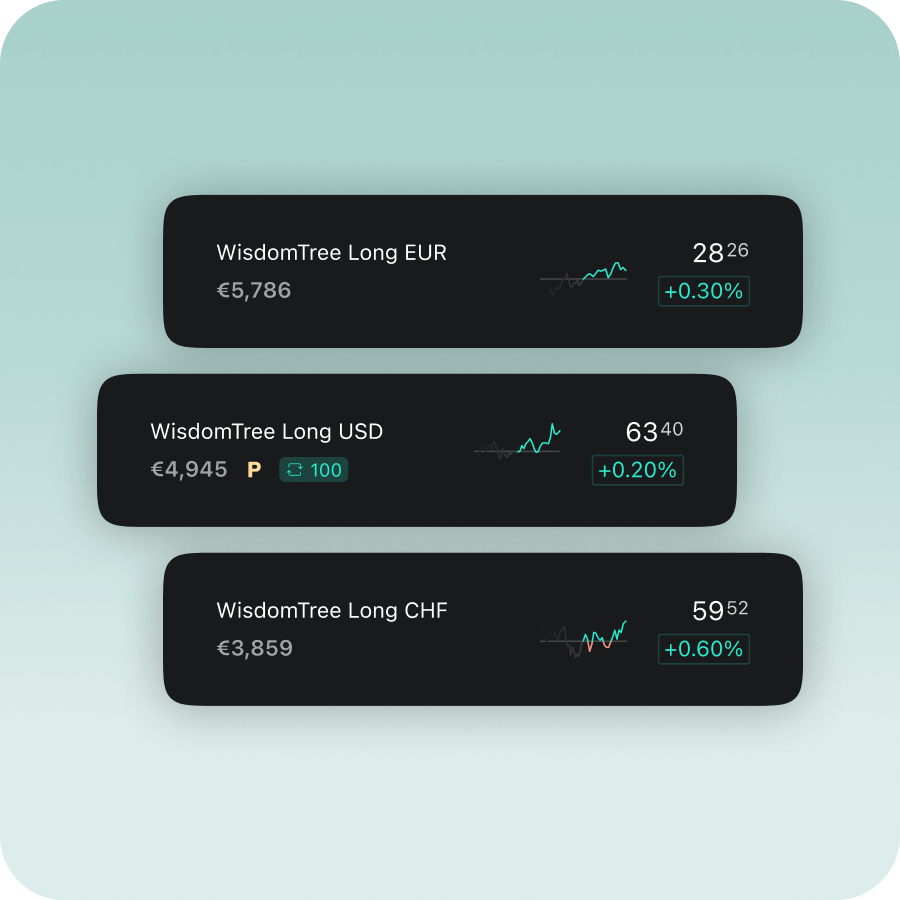

Discover a wide range of currency ETPs and trade without limits at a flat rate with the PRIME+ Broker.

WisdomTree Long USD Short EUR

ISIN |

JE00B3RNTN80 |

WKN |

A1EKY1 |

TER |

0,39 % p.a. |

Not a customer yet? Open an account

WisdomTree Long CHF Short EUR

ISIN |

JE00B3MR2Q90 |

WKN |

A1BEGH |

TER |

0,39 % p.a. |

Not a customer yet? Open an account

WisdomTree Long USD Short GBP

ISIN |

JE00B3WPFZ34 |

WKN |

A1E3G3 |

TER |

0,39 % p.a. |

Not a customer yet? Open an account

Investing through ETPs

For a long time, foreign exchange markets were reserved for investors with a lot of experience. Currency ETPs now offer a simpler investment solution: they provide a cost-effective way to participate in the performance of various currencies. ETPs are products that track the performance of a currency pair and are traded on regulated markets.

What are the advantages of investing in currencies through ETPs?

Availability: Currency ETPs are traded on the stock exchange. This means they can be traded at any time during trading hours. | |

Costs: Investing in currencies through ETPs is generally cost-effective. Since investors no longer have to buy individual currencies, but instead acquire currency pairs via a corresponding ETP, they can benefit from low fees (TER). | |

Diversification: With currency ETPs, different currencies can be included in an ETF portfolio in a simple, transparent and cost-effective way. |

Frequently asked questions

You can choose between two models:

FREE Broker:

No order fees1 for savings plans. For trades on the European Investor Exchange and gettex, order fees of €0.99 apply.

PRIME+ Broker:

For just €4.99 per month, you can enjoy unlimited trades on the European Investor Exchange and gettex without order fees1 for transactions over €250, plus savings plans starting at €1 on stocks, ETFs, and other exchange-traded products (ETPs). Trades under €250 on European Investor Exchange cost only €0.99."

Xetra trades:

For order execution via gettex or Xetra stock exchanges, an order fee of €3.99 per trade applies to all clients, along with a trading venue fee of 0.01% of the order volume (with a minimum of €1.50), regardless of the pricing model. This fee covers all third-party trading and settlement costs. Partial executions are charged only once.

There are no additional costs such as securities account fees, flat-rate third-party fees, or issue surcharges. Find a cost overview here.

1Product costs, spreads, inducements and crypto fees may apply.

Learn more.

Especially globally relevant currencies are often traded against each other. The most traded currency pairs are mainly EUR/USD (Euro/US Dollar), USD/JPY (US Dollar/Japanese Yen) and GBP/USD (British Pound/US Dollar).

1. Diversification

By investing in foreign currencies, you can spread your risk across different markets and currencies, reducing your dependence on any particular currency or market.

2. Risk management

Currencies fluctuate in value and therefore provide an opportunity for trading. In addition, you can use foreign exchange to manage the risk of currency fluctuations or to hedge against inflation. Example: If investors from the USA expect political risks or strong inflation in their own country, they can hedge by placing a forex trade from US Dollar against Euro.