Commodities & precious metals at Scalable Capital

More diversification

for your portfolio

Trade over 20 different commodities with the Scalable Broker now. Simply invest in

individual commodities or entire baskets - in savings plans already from €1.

Investing involves risks.

What are commodities?

Commodities are natural resources that occur in nature and are processed for various purposes.

The most important characteristics:

They are an essential part of the economy, as they are needed in the production of various products. | |

Their performance usually shows little correlation with the performance of stocks or bonds. | |

Their prices can be influenced by unpredictable factors such as natural disasters or economic booms. |

Commodities include the following products:

Energy

(petroleum)

Precious metals

(gold, silver, platin, palladium)

Agricultural commodities

(coffee, wheat)

Minerals

(phosphorate, sulphur)

Industrial metals

(copper, aluminium)

Which commodities can be traded at Scalable Capital?

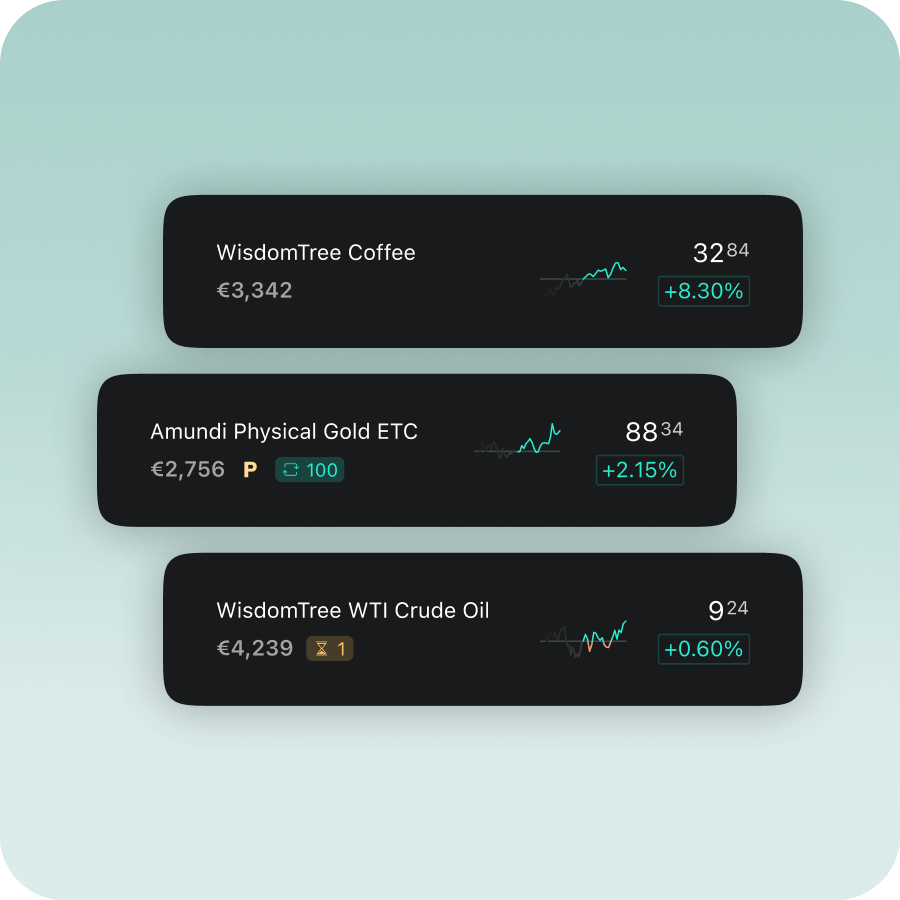

In the Scalable Broker, you have access to a variety of commodity ETPs. Popular commodities are for example oil or gas as well as precious metals such as gold and silver. You can find a selection of different commodity ETPs in the Scalable Broker here:

Ways to an investment in commodities

At Scalable Capital, you can buy stocks of commodity companies or speculate with derivatives on the price development of commodities. Or you can invest with cost-effective exchange traded products (ETPs) in the development of commodity prices.

Stocks

Buying a stock, investors can acquire parts of a company, which produces or trades commodities.

Commodity-ETPs

Commodity ETFs track the price of a basket of selected commodities. |

Commodity ETCs track the performance of a single commodity. |

Derivatives

Derivatives allow speculation on commodity prices.

Advantages ETPs

Simple access to investments in commodities | |

As easy tradable as stocks and ETFs in the Scalable Broker | |

Lower costs than physical acquisition of commodities | |

Some ETPs are physically backed |

Disadvantages ETPs

No physical trading of the underlying commodity | |

Insolvency of the issuer can lead to a substantial loss up to total loss | |

The performance may deviate from that of the underlying |

Variety and potential for your portfolio

Investing in commodities can be beneficial due to additional stability & protection against inflation.

Commodity prices are usually little connected to the development of the stock market and can thus contribute to the diversification of the portfolio. Furthermore, commodities have historically often acted as a hedge against inflation, when the price level rises. The chart shows how commodities and equities have performed in the four major inflation outbreaks of the last 150 years.

Source: justETF , April 2023

Invest in commodities - simple in 3 steps

Easily open a securities account at Scalable Broker and get started.

FAQ

Frequently asked questions about commodities and precious metals

Popular precious metals are gold, silver and palladium. Gold, silver and palladium have been considered popular economic and thus investment goods for centuries. Palladium is used in many everyday products, for example in electronic devices. The metal is increasingly replacing the expensive platinum.

You can trade more than 20 commodities in the Scalable Broker, among which for example precious metals such as gold and silver, industrial metals such as copper or agricultural commodities such as wheat or coffee.

You can choose between two models:

FREE Broker:

No order fees1 for savings plans. For trades on the European Investor Exchange and gettex, order fees of €0.99 apply.

PRIME+ Broker:

For just €4.99 per month, you can enjoy unlimited trades on the European Investor Exchange and gettex without order fees1 for transactions over €250, plus savings plans starting at €1 on stocks, ETFs, and other exchange-traded products (ETPs). Trades under €250 on European Investor Exchange cost only €0.99."

Xetra trades:

For order execution via gettex or Xetra stock exchanges, an order fee of €3.99 per trade applies to all clients, along with a trading venue fee of 0.01% of the order volume (with a minimum of €1.50), regardless of the pricing model. This fee covers all third-party trading and settlement costs. Partial executions are charged only once.

There are no additional costs such as securities account fees, flat-rate third-party fees, or issue surcharges. Find a cost overview here.

1Product costs, spreads, inducements and crypto fees may apply.

Learn more.

Commodities offer investors a good opportunity to diversify their own portfolio. This is because commodities often develop independently of other asset classes: An addition of commodities can therefore serve to reduce risk and contribute to additional diversification.

Commodities, and precious metals in particular, are also suitable as inflation hedges, because a correlation can be seen between commodities and the inflation rate. This is clearly illustrated by the example of gold: if there is an increase in the price level, the gold price has historically often developed positively. That is why investments in gold and other precious metals are often described as a "safe haven" in times of crisis.

An investment in an individual commodity or a commodity index is possible via so-called exchange traded products (e.g. via ETFs or ETCs). The products track the performance of the underlying commodity or commodity index. Some of the products also physically deposit the commodity (e.g. gold).

At Scalable Capital, you can invest in commodities via ETPs. To do so, select the desired commodity ETP in the client area. Use the "Buy" or "Sell" buttons to start the order process. The sell option is only available if you already hold shares of the security.

Whichever type of investment you choose, the following aspects should be taken into account.

The physical purchase of precious metals is usually associated with high costs. Costs are incurred for safekeeping, for example, but also for the sale of precious metals. This is because investors must first have the authenticity of the precious metal confirmed. One argument in favour of a physical purchase is that precious metals can be used in crisis or emergency situations to buy food or other essential products. It is precisely this option that is often seen as a disadvantage of ETCs. In addition, ETCs are debt securities that are not part of the special assets. In the event of the issuer's insolvency, there is therefore a risk of considerable losses, up to and including total loss. To counteract this, however, there are ETCs for some commodities - such as gold - that physically deposit the underlying commodity.

As important and necessary as commodities are for the economy and society, we must be aware that the extraction of commodities is often associated with social and ecological risks. Therefore, the question arises to what extent investments in commodities can be reconciled with sustainability. There are a number of products available to investors that focus on sustainability. These include, for example, so-called ex-agriculture products, which completely exclude investments in alimentary products.