Derivatives in the Scalable Broker

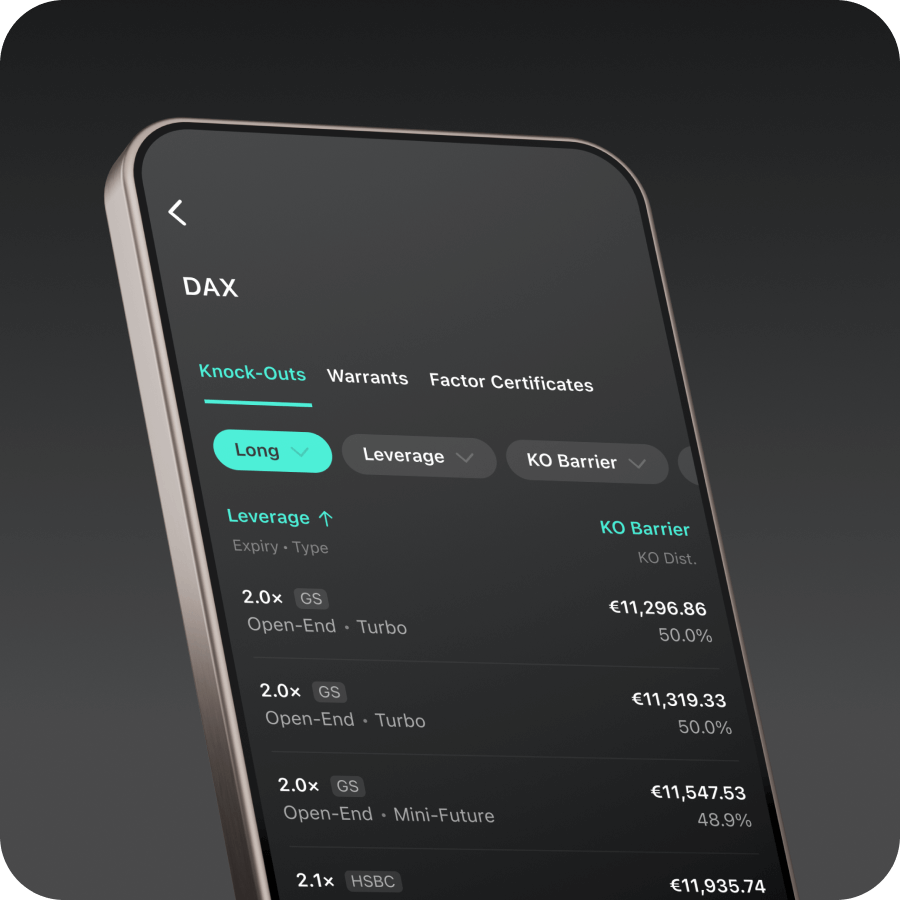

Unlimited derivatives trading

Short, long, hedging: Implement all your investment ideas now with over 625,000 derivatives and a trading flat rate.

Derivatives entail high risks.

Trade more than 625,000 derivatives

You decide how you trade to protect your portfolio from adverse market movements or implement a specific trading idea: from long to short strategies to targeted hedging.

Over 625,000 derivatives: Certificates, knock-outs, warrants and more from BNP Paribas, Goldman Sachs, HSBC Germany and UniCredit | |

Flat rate trading in PRIME+ for €4.99/month | |

Instant trading with intraday emissions of HSBC products |

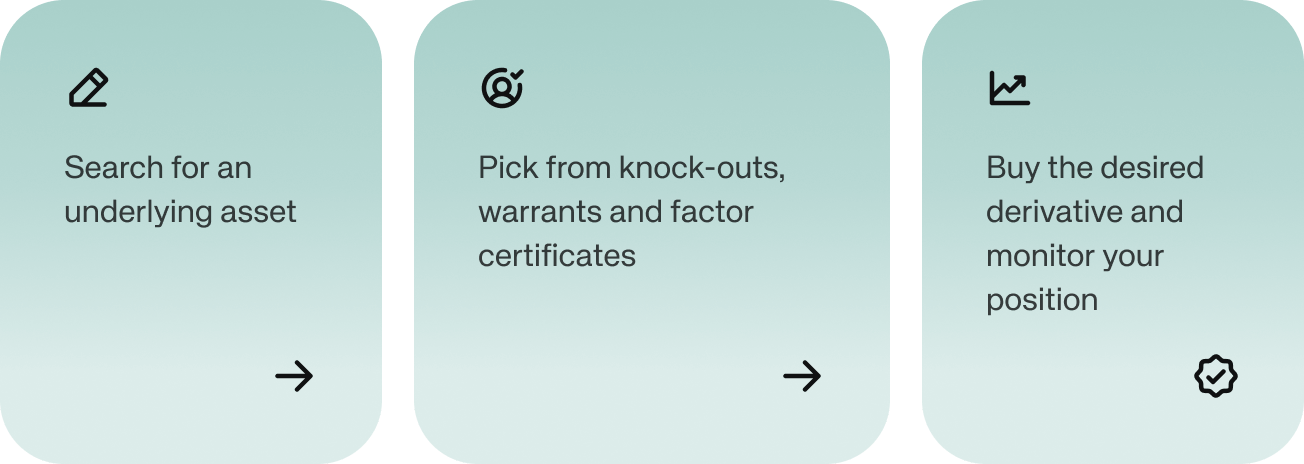

Trade derivatives effortlessly

Open a securities account

with Scalable and start trading

Choose how you want to trade

Popular |

||

|---|---|---|

FREE |

PRIME+ |

|

Costs 1 |

€0.99 / trade |

€0.00 / trade |

Interest |

2% p.a.* |

2% p.a.* |

Cash distribution |

Scalable, partner banks and |

Scalable and partner banks |

Crypto |

0.99% spread |

0.69% spread |

Credit |

4.24% p.a. |

3.24% p.a. |

Advanced features (Portfolio analysis, price alerts and more) |

Limited |

Full version |

1 PRIME+ Broker: €0 for trades of €250 or more, otherwise €0.99. FREE Broker: €0 for purchases of PRIME ETFs (all Amundi, iShares, Xtrackers ETFs) of €250 or more, otherwise €0.99. All broker models: €0 for savings plan executions. Crypto fees, product costs, spreads and/or inducements may apply. Compare broker plans in detail.

Derivatives by leading issuers

BNP Paribas

BNP Paribas is one of the leading derivatives providers worldwide, offering a wide and up-to-date range of leveraged products, certificates and equity-linked bonds. BNP Paribas provides over 250,000 products available, BNP Paribas is regularly recognized for its outstanding performance. Excellent trading quality, a broad selection of underlying assets, and exceptional service complete the offering.

Goldman Sachs

Goldman Sachs offers leverage products such as knock-outs, warrants and factor certificates as well as investment products such as bonus, discount and reverse bonus certificates in Germany. Investors can currently choose from around 170,000 products on more than 1,000 underlyings and thus invest indirectly in shares, indices, currencies, interest rates or commodities.

HSBC

At HSBC Germany, 30 years of experience in the field of certificates and leverage products result in award-winning investor service, outstanding trading quality and a strong product offering. HSBC Germany was founded in 1785 and is part of the HSBC Group, one of the largest financial institutions in the world.

UniCredit

UniCredit is a pan-European commercial bank with fully integrated Corporate & Investment Banking. UniCredit Bank GmbH is one of the top issuers in Germany and offers a wide range of products and services. This includes a broad selection of all major product types and underlyings from the asset classes of equities (indices), commodities, interest rates and currencies.

FAQs

Frequently asked questions about derivatives trading in the Scalable Broker are answered in our Help Center.