The investment strategy InterestInvest

2.5% target return1:

The smart alternative to overnight deposits

Benefit from high interest rates on the money market and short-term bonds.

When investing, your capital is at risk. Learn more about risk here.

1The target return depends on market developments and is shown before costs. It was calculated on the basis of the portfolio components’ return as of 03.03.2026. The ETF costs (0.13% p.a.) and wealth management/trading fees (0.75% p.a.) will have a yield-reducing effect. Expected returns are forecasted and do not represent a reliable indicator of future performance.

Is InterestInvest a fit for me?

Find out who the InterestInvest strategy might be suitable for.

ZinsInvest might be of interest to you if you:

|

want to participate in the current interest rate trend continuously without having to constantly change banks, |

|

at the same time want low fluctuations in value, |

|

want to be able to access your money at short notice at any time, and |

|

want to park your money for a short to medium-term investment period. |

Investing involves risks.

Would you prefer to invest for the long term? Then take a look at our other strategies.

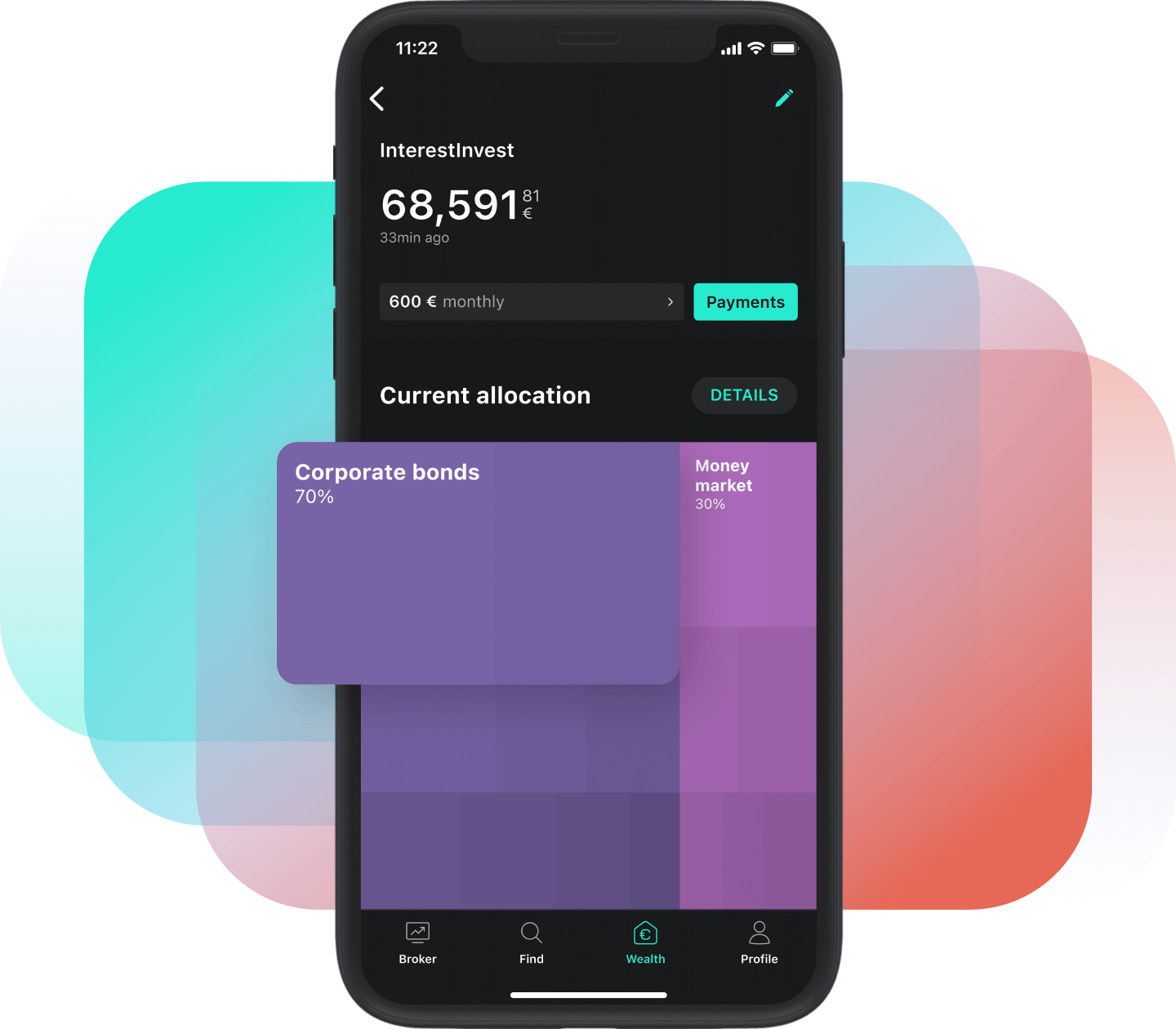

This is how InterestInvest works

Benefit from high interest rates over a short to medium-term investment period.

The ETF portfolio invests in the money market and in short-term bonds with low risk profiles. The focus is on a broadly diversified investment in corporate bonds with a high credit rating (so-called investment grade rating). As a result, the portfolio is diversified and as low in volatility as possible. The target return is directly dependent on market interest rates and is based on the key interest rates of the European Central Bank (ECB). Learn more.

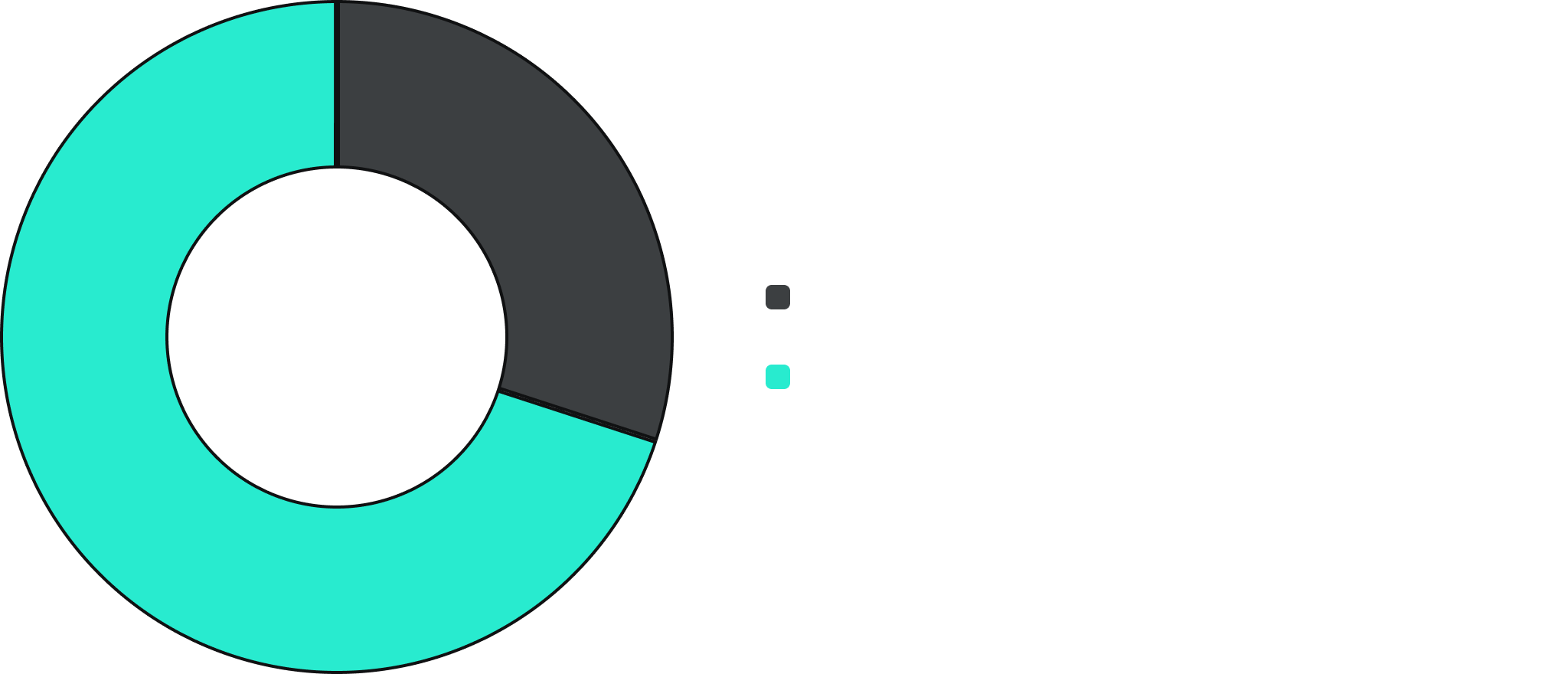

Portfolio allocation

The InterestInvest strategy invests exclusively in short-term bonds and money market ETFs. We thus cover the market-based interest rate trend.

Performance at a glance

Note: Past performance is not a reliable indicator of future performance.

InterestInvest in Detail

Participate in the new interest rate environment with ETFs.

Low fluctuations

The key interest rate hikes by the European Central Bank (ECB) made it possible: interest rates are back on the rise.

And with InterestInvest you automatically benefit from this, through an investment in the money market and short-term corporate bonds that allow participating in the interest rate trend.

By combining these two asset classes and a smart selection of ETFs, the portfolio can offer an attractive target return1 with only minor fluctuations.

Diversification

On the money market, governments, banks and companies lend money to each other on a short-term basis. A money market investment is characterised by high liquidity and high security.

Our ETF portfolio focuses on bond ETFs with a short duration (on average around one year to maturity), as these are less sensitive to changes in interest rates than those with a longer residual term.

Security

The selected ETFs mainly invest in high-quality bonds from large companies with a very low probability of default, such as Mercedes, Allianz or Goldman Sachs. Even in the event of a default, the risk of the overall portfolio is limited through the broad diversification across thousands of securities.

| |

SecurityThe ETFs used in the portfolio are special assets and are protected against insolvency (e.g. by the custodian bank or Scalable) to an unlimited extent. InterestInvest is therefore also suitable for larger investment amounts. |

|

CostsInterestInvest incurs ETF costs of 0.13 percent per year as well as ongoing costs for portfolio management and trading of 0.49 to 0.75 per cent per year, depending on the investment amount. Learn more. |

Frequently asked questions

The 5 most important differences are:

- In contrast to a traditional overnight and fixed-term deposit account, the target return is not determined by the bank's management. Instead, you benefit directly and permanently from the interest rates offered by the money market and the market for short-term bonds.

- In return for the higher yield, the portfolio is subject to minor fluctuations. The expected annual fluctuation range (volatility) of the portfolio is around 1 percent.

- With InterestInvest, the ongoing earnings are reinvested.

- ETFs are special assets and are protected against insolvency to an unlimited extent. In contrast to deposit protection for overnight money, there is no maximum investment amount.

- ETF costs and the costs for asset management and trading reduce the return on the investment.

No, there is no minimum investment period. The InterestInvest strategy is suitable for short to medium-term investments from an investment period of around six months. Nevertheless, you can access your money at any time and withdraw it with one click.

The target yield is derived from market interest rates and is updated once a month. It depends on the interest rate development of short-term bonds and the key interest rate of the European Central Bank (ECB).

Falling interest rates (e.g. as a result of a key interest rate cut by the ECB) lead to a lower expected return (target return*) for the future. In addition, investors benefit from (small) price gains on bonds held, as the fixed-interest period (duration) of the portfolio is around one year.

With InterestInvest, the current interest payments (called coupons for bonds) are reinvested. There is currently no payout of interest payments. But a withdrawal plan can be set up for all our strategies. This allows constant monthly payments to be made to the reference account.

We collected more answers to frequently asked questions for you.

1The target return depends on market developments and is shown before costs. It was calculated on the basis of the portfolio components’ return as of 03.03.2026. The ETF costs (0.13% p.a.) and wealth management/trading fees (0.75% p.a.) will have a yield-reducing effect. Expected returns are forecasted and do not represent a reliable indicator of future performance.