Stocks in the Scalable Broker

Unlimited investing

in stocks

Trade more than 8,000 global stocks. 4,500 available for savings plans from €1.

Investing involves risks.

Stock trading

More than 8,000 stocks available | |

No minimum order volume | |

Unlimited in the trading flat rate starting from €250 or for only €0.99 per trade |

Stock savings plan

4,500 stocks available | |

Commission-free1 | |

From €1 savings amount |

1Product costs, spreads, crypto fees and /or inducements may apply.

Smart features support your trading

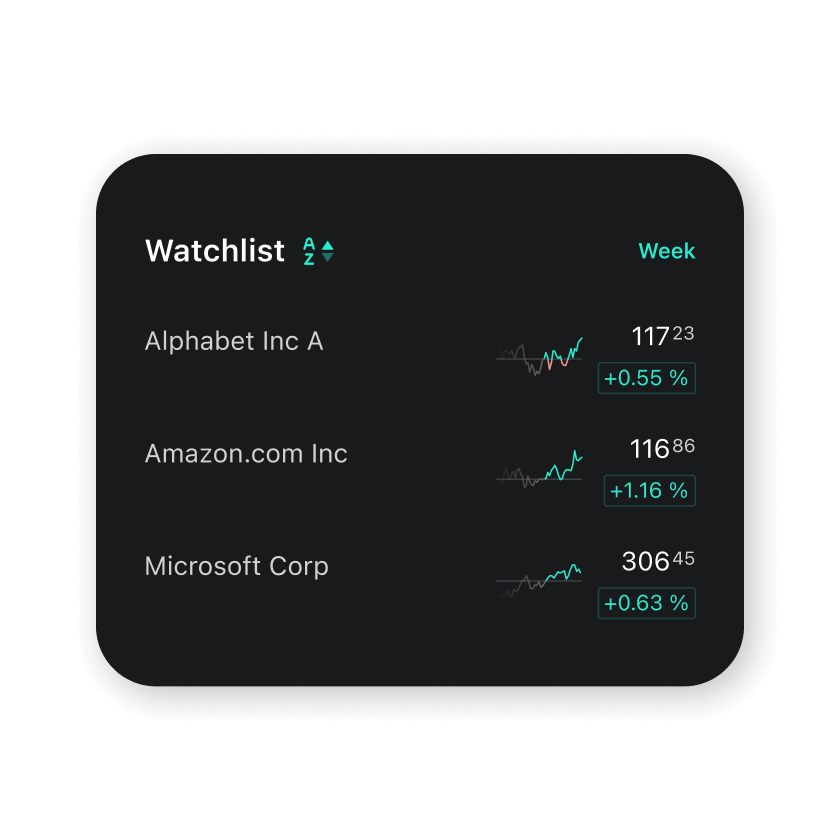

Watchlist

If you are not sure yet, if you want to buy a stock already or just want to keep an eye on it, you can add it to your watchlist.

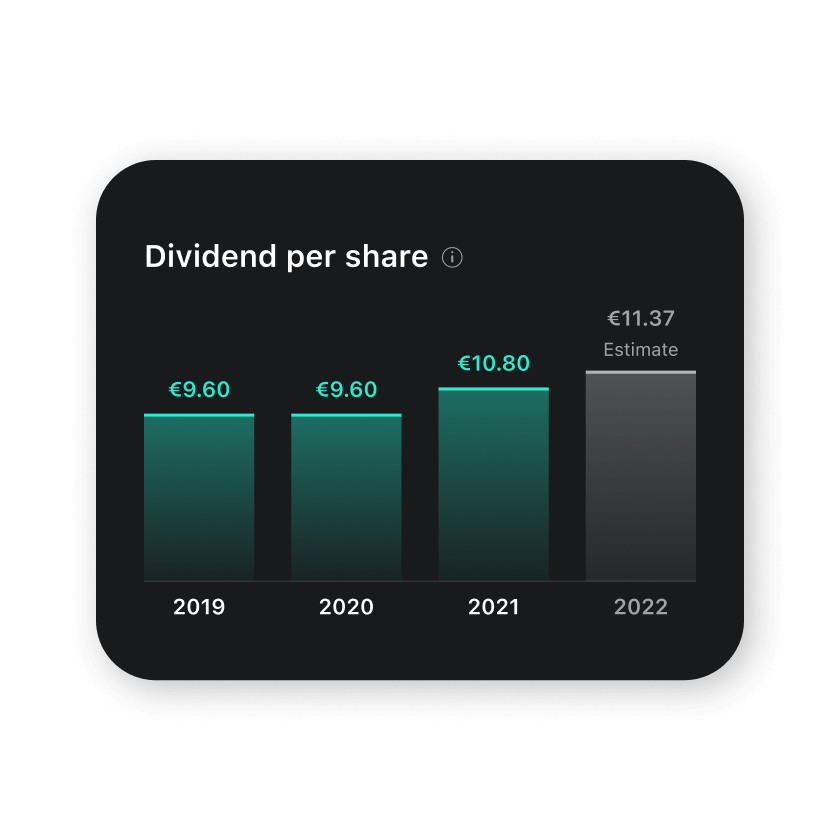

Financial ratios

Financial ratios help you make investment decisions. Learn more.

Securities lists

Securities lists provide you with inspiration for future investments.

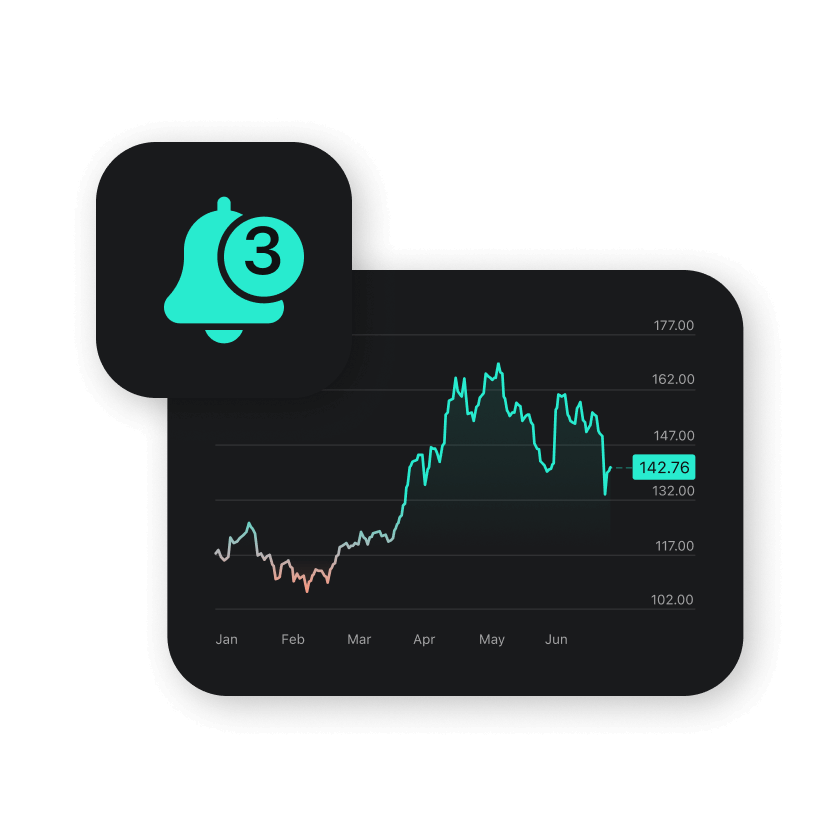

Price alerts

Set up price alerts to not miss an ideal stock price.

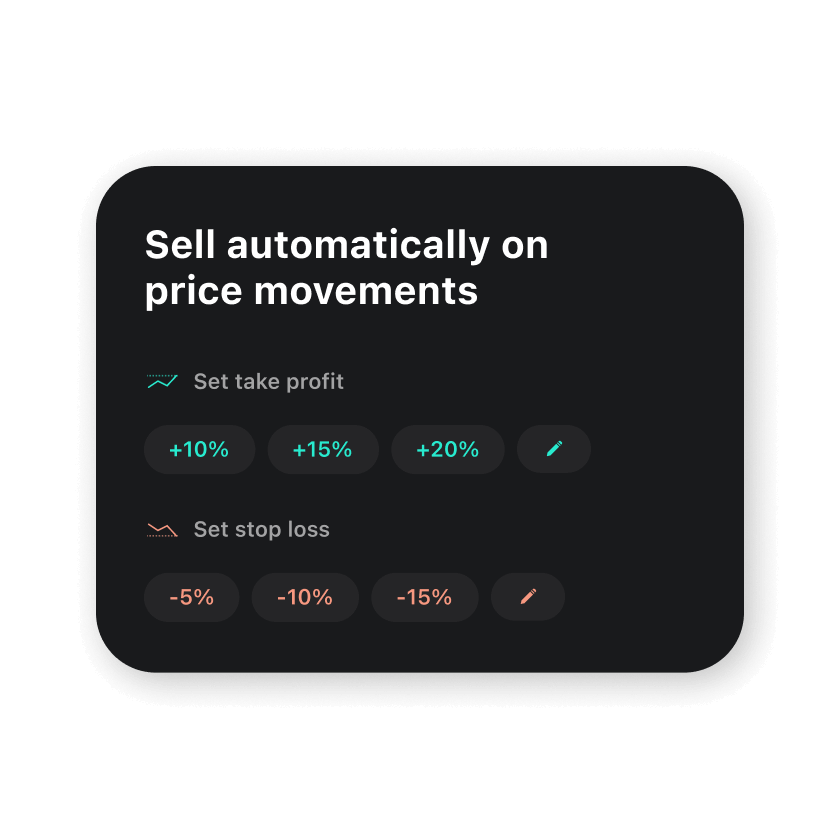

Order types

Different order types such as limit, stop-loss or take profit support you to not have to constantly keep an eye on prices and execute orders automatically

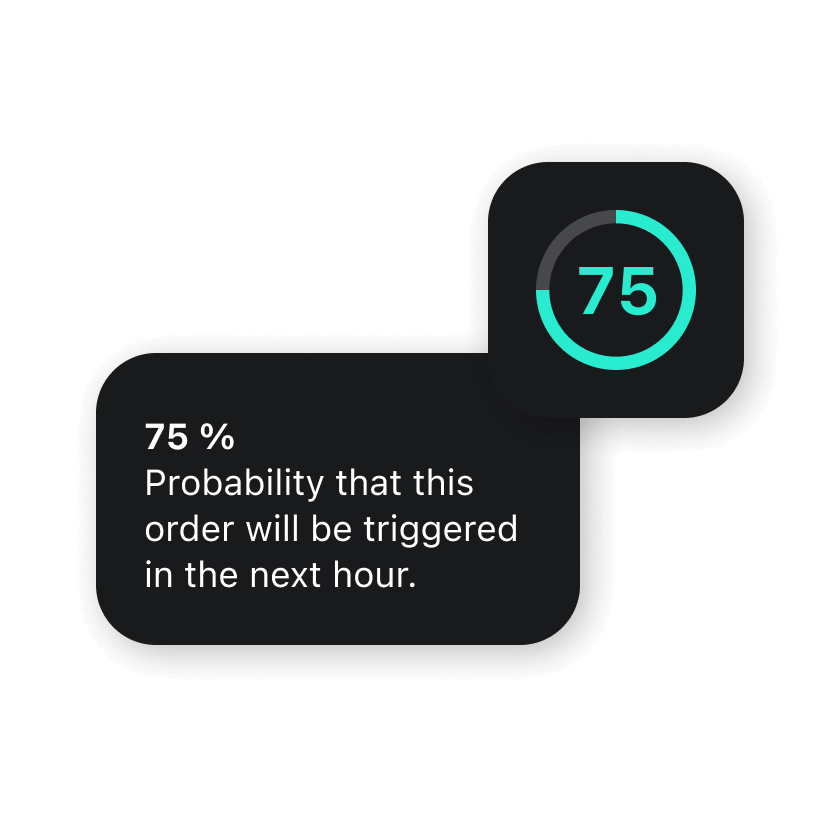

Smart Predict

Smart Predict tells you how high the probability is that your instructed order will be executed within the next hour.

What are stocks?

Stocks are securities with which companies raise money on the capital market. The most important features:

With the purchase of a stock, you acquire shares in a company. | |

Accordingly, the stock gives you a share in the assets as well as the profits and losses of the company. | |

Stocks generate higher long-term returns than other asset classes, but are also more risky. |

You can read a more detailed explanation about what stocks are, what function they provide for companies and how stock prices evolve in our knowledge article.

Frequently asked questions

Profit: Stock trading influences the stock price and with a rising price the value of the stock also increases. Moreover, some companies additionally pay out part of these profits in the form of dividends.

Return opportunities: Historically, stocks have generated the highest returns of all forms of investment in relation to risk. Over the past 35 years, the German share index (DAX) has recorded an average annual return of eight to nine percent.

Participation rights: When you buy a stock, you get the right to vote at the annual general meeting and have a say in important decisions in the company.

Personal interests: You can support your favourite company or support areas that interest you, such as climate protection through e.g. investments in the solar or wind industry.

In principle, all stocks that are traded on the European Investor Exchange, gettex and Xetra stock exchanges are available to you.

The decision in which stock to invest is not always easy. You should consider important financial ratios such as the market capitalisation, the price-earnings-ratio, the dividend yield and more. You can also have a look at which stocks are included in the most important indices. We explain here what an index is.

You can choose between two models:

FREE Broker:

No order fees1 For trades on the European Investor Exchange and gettex, order fees of €0.99 apply.

PRIME+ Broker:

For just €4.99 per month, you can enjoy unlimited trades on the European Investor Exchange and gettex without order fees1 for transactions over €250, plus savings plans starting at €1 on stocks, ETFs, and other exchange-traded products (ETPs). Trades under €250 on European Investor Exchange cost only €0.99."

Xetra trades:

For order execution via gettex or Xetra stock exchanges, an order fee of €3.99 per trade applies to all clients, along with a trading venue fee of 0.01% of the order volume (with a minimum of €1.50), regardless of the pricing model. This fee covers all third-party trading and settlement costs. Partial executions are charged only once.

There are no additional costs such as securities account fees, flat-rate third-party fees, or issue surcharges. Find a cost overview here.

1Product costs, spreads, inducements and crypto fees may apply.

Learn more.

Orders can be placed on European Investor Exchange, gettex or Xetra.

The European Investor Exchange electronic trading system is operated by Scalable Capital together with the Hanover Stock Exchange, and generally does not charge brokerage or exchange fees. This applies also to gettex.

For Xetra, an order fee of €3.99 per trade applies to all clients, including those using the PRIME+ Broker. Additionally, a trading venue fee of 0.01% of the executed volume (with a minimum of €1.50) is charged. This fee covers all third-party costs for trading and settlement.

An overview of all costs can be found here.

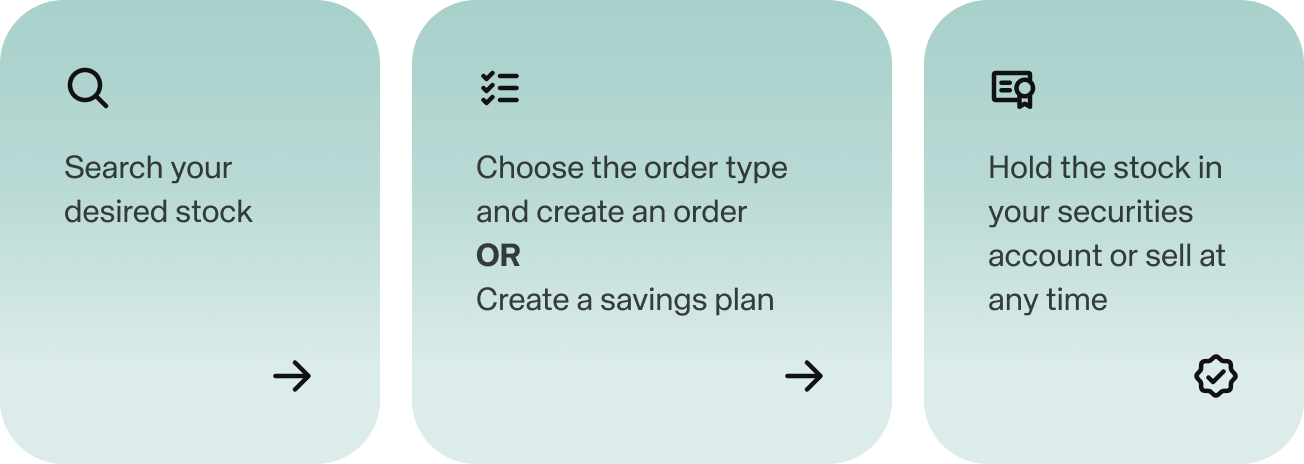

Trading orders can only be accepted via the client area on the web or in the apps. Telephone orders in particular are expressly not possible. Select the desired stock in the client area. Use the "Buy" or "Sell" buttons to start the order process. The sell option is only available if you already hold shares in the security.

Many stocks that are available in the Scalable Broker can also be purchased through savings plans. There are no restrictions regarding the size of the company or the location of its headquarters.

We are constantly reviewing whether a savings plan function can be set up for new securities in order to constantly expand our offering.

Find the security you want through the search function and click on "Set up a savings plan" on the overview page. In the app, you will see the savings plan option underneath the “Buy” and “Sell” option, while in the web browser, you will see the option on the top right.

You can then select the amount you wish to invest, the frequency of the savings plan, the execution date, starting month and inflation adjustment.

You can also choose the deposit method: Deposits to fund your savings plans can be made by direct debit or from your Scalable account cash balance.

To confirm, click “Set up savings plan”.

Buy stock fractions: You cannot buy fractions directly. However, with all savings plans we also buy fractions of stocks for you so that your savings amount can be fully invested. As long as your savings plan is active, these fractions are repeatedly combined to form whole number securities.

Sell stock fractions: If you want to sell a security that has been acquired via a savings plan and therefore contains fractions, you can of course also sell the resulting fractions again. Please note that no individual fractions can be sold, but rather the entire position must be sold.

For stocks of German companies you are entitled to a dividend if you hold the stock in your securities account on the day of their Annual General Meeting (AGM). From the first trading day after the AGM, the stock is traded "ex-dividend", as from then on there is no longer any entitlement to dividends. When you receive a dividend, it is automatically credited to your clearing account. However, the actual distribution of the dividend does not have to take place immediately after the AGM.

For dividends from foreign companies, some of which pay out a dividend several times a year, please refer to the quarterly reports or the investor relations page of the respective company.

Yes, for registered shares you will receive an announcement in your Scalable Mailbox informing you about the upcoming Annual General Meeting.

After receiving this announcement, please let us know, whether you would like to participate, by returning the enclosed form until the indicated date.

You will then receive another Mailbox message with the corresponding shareholder number, which you can use to independently register for the Annual General Meeting.