WEALTHSELECT

Stability in all

economic phases

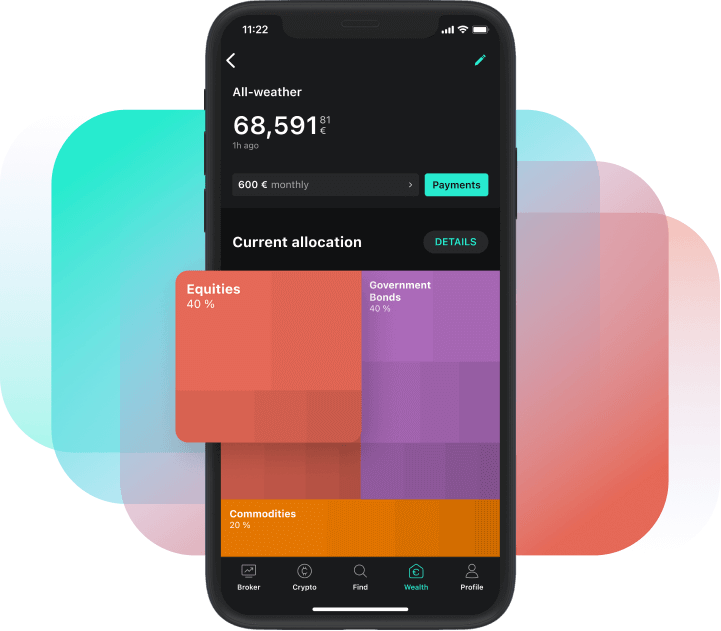

Invest broadly in different asset classes with the Allweather

strategy.

When investing, your capital is at risk. Learn more about risk here.

The Allweather

Strategy

The all-weather strategy goes back to the US hedge fund manager Ray Dalio. The aim is to keep the volatility of the portfolio as low as possible across all market phases while aiming for high returns.

|

Suitable for all who value stability |

|

Broad investment in various asset classes - from equities to bonds to commodities - with globally diversified ETFs. |

Portfolio allocation

In the Allweather strategy, the equity quota is set at 40%.

Performance at a glance

Note: Past performance is not a reliable indicator of future performance.

Current investment universe

Asset class | Financial Product | Weight |

|---|---|---|

Equity / US | iShares S&P 500 Swap UCITS ETF | 23.90% |

Equity / Europe | Amundi Stoxx Europe 600 UCITS ETF | 7.60% |

Equity / Japan | Amundi Prime Japan UCITS ETF | 2.30% |

Equity / Pacific ex-JP | L&G Asia Pacific ex Japan Equity UCITS ETF | 1.40% |

Equity / EM | iShares Core MSCI Emerging Markets IMI UCITS ETF Acc | 3.60% |

Equity / China | Xtrackers CSI 300 Swap UCITS ETF | 1.20% |

Govt Bond / DE MT | iShares eb.rexx Government Germany 5.5-10.5yr UCITS ETF | 20.00% |

Govt Bond / DM IL | iShares Global IL Govt Bond UCITS ETF (EUR Hedged) | 20.00% |

Gold | WisdomTree Core Physical Gold ETC | 14.00% |

Commodity | Xtrackers Bloomberg Commodity ex-Agriculture & Livestock Swap | 6.00% |

The costs at a glance

Let us manage your assets. Transparent and inexpensive. Learn more about our costs.

Calculate your costs

Portfolio value

€20Total costs per year

Administration & trading

ETF costs (TER)

Total

When calculating the total annual costs, the individual fee levels are taken into account.

Status of product costs: December 2024