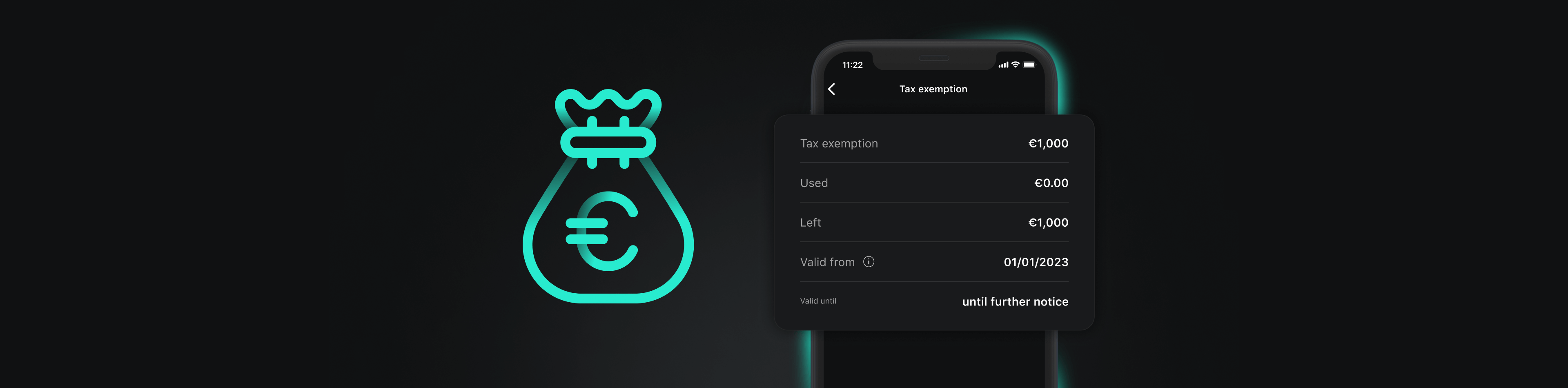

Good news for all investors with tax residence in Germany: the tax allowance, i.e. the tax-free amount that you can use for your investment income, is increasing.

The statutory increase applies from 2023 and includes an increase from €801 to €1,000 or from €1,602 to €2,000 in the case of a joint allowance. This tax allowance increase makes it all the more worthwhile for German clients to participate in the capital markets.

Our custodian bank will take these changes into account and automatically adjust the tax exemption of your Scalable account for 2023.

This is how the automatic adjustment works

In your Scalable account, you have set the amount of your tax exemption under Profile. This will be automatically adjusted on 3 January 2023 in accordance with the statutory increase. You do not have to do anything yourself.

If you did not set up a tax exemption, no change will be made.

Examples of the tax allowance adjustment

You have specified the maximum amount of €801 in your tax exemption with Scalable Capital. As of 3 January 2023, this value will automatically increase to the new maximum amount for single persons of €1,000.

If you have specified any lower amount instead of the maximum amount, the value will automatically increase by 24.844%. This percentage corresponds to the proportionate amount by which the tax allowance increases for the maximum values (€801 to €1,000).

If you have not set up a tax exemption, the amount will continue to be €0.

Taxation of investment income

Anyone who is liable to pay tax in Germany and earns capital gains must pay a capital gains withholding tax of 25%. The solidarity surcharge and, if applicable, church tax are added to this. The maximum tax burden thus rises to just under 28%. The use of the tax exemption makes it possible not to have to pay tax on capital income up to an amount of €1,000 (in the case of single assessment) or € 2,000 (in the case of jointly assessed persons) per year. If you issue an exemption order, the custodian bank does not deduct the otherwise due final withholding tax on investment income until the saver's flat-rate amount is reached. This means that no unnecessary tax burden arises.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.