Scalable Wealth

Simply invest automatically

With Scalable Wealth, investing is relaxed, intelligent and automated. Start investing with just €5,000.

When investing, your capital is at risk. Learn more about risk here.

+1 million build their wealth |

|

+ €20 billion in client assets |

|

Top-rated app |

|

Security Custody of securities with |

Investing without the hassle

Scalable creates and manages your portfolio. Let us invest your money and sit back.

Portfolio creation

Portfolios that suit you: we offer different investment strategies to help you achieve your individual goals.

Ongoing portfolio monitoring

We always keep an eye on your portfolio and automatically adjust it to market events.

Choice of low-cost ETFs

We always select the most advantageous ETFs for your portfolio from over 2,000 ETFs in a multi-stage process.

Personal customer service

Professional and reliable: Our team is always there for you. By phone, chat as well as by e-mail.

Always and everywhere available

You can access your custody account at any time via app and web. There is neither a minimum holding period nor a minimum term.

Stay flexible

Build up assets gradually with savings plans and retire relaxed with flexible withdrawal plans

Strategically well positioned

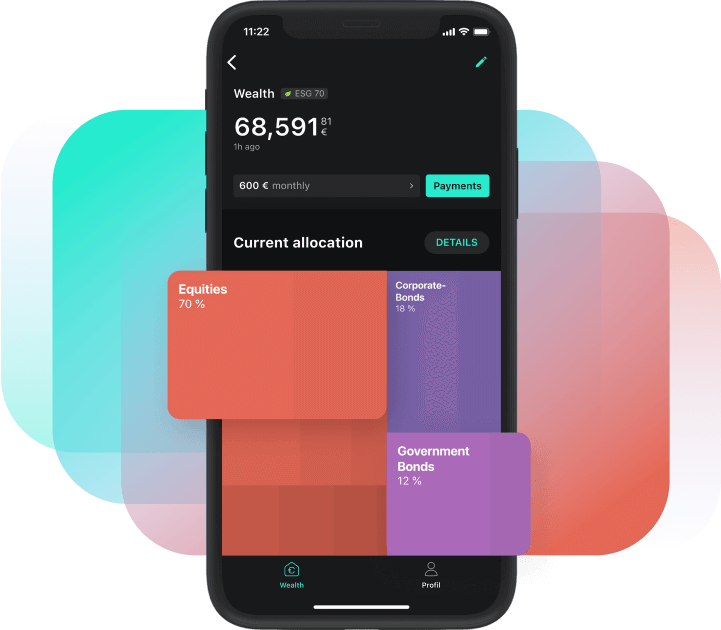

With investment strategies that align with your values and goals. With Scalable Wealth, you can choose from many different investment strategies - from globally diversified to more specific.

WEALTHGLOBAL

Invest globally with the World Portfolios

Invest globally diversified and optionally with ESG focus in all major asset classes.

|

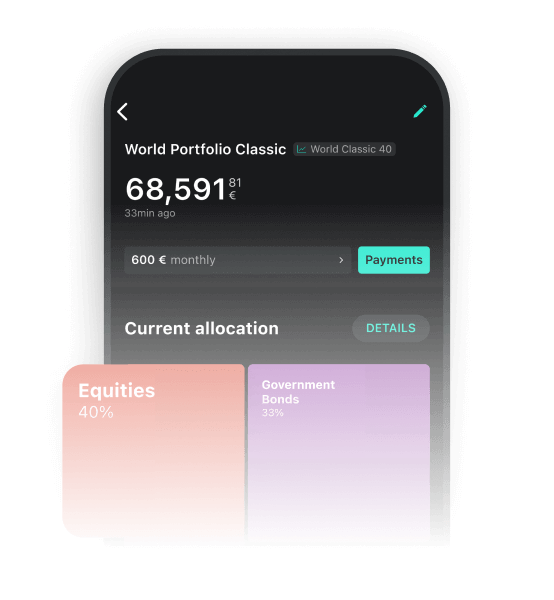

WEALTHSELECT

Invest with a special investment focus

Specific investment ideas and special strategies - with portfolios such as Climate Protection, Megatrends, Value or Allweather.

|

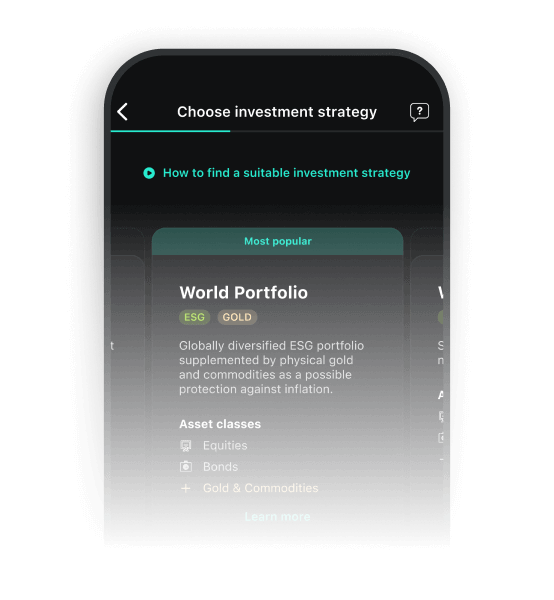

In 3 steps to your first portfolio

This is what simple investing looks like:

Select investment strategy

Now choose a suitable investment strategy

based on your investment type - from

globally diversified strategies to value and robust

allweather strategies.

Learn more

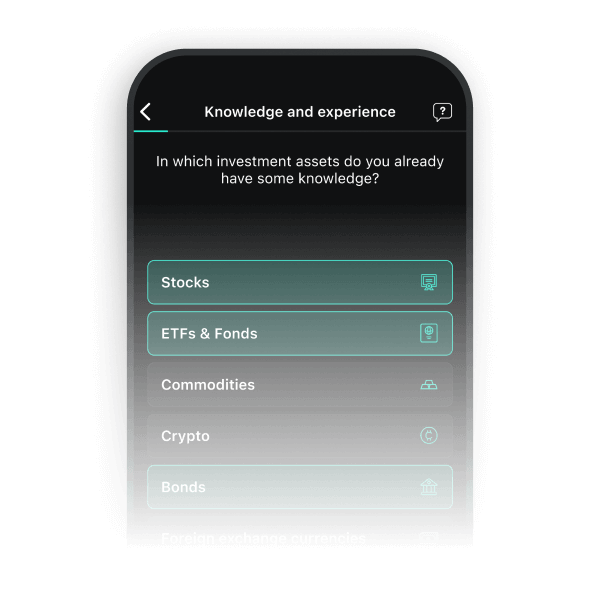

Determine investment type

With the help of a short questionnaire, we

find out more about your investment goals

and investment horizon and thus determine

your risk tolerance.

Sit back and let us

do the work

We put together a portfolio of low-cost,

diversified ETFs for you, monitor it on an

ongoing basis and adjust it automatically if

necessary.

The costs at a glance

Let us manage your assets. Transparent and inexpensive.

.Calculate your costs

Portfolio value

€5,000Total costs per year

Administration & trading

ETF costs (TER)

Total

Status of product costs: March 2024