Investing

for everyone

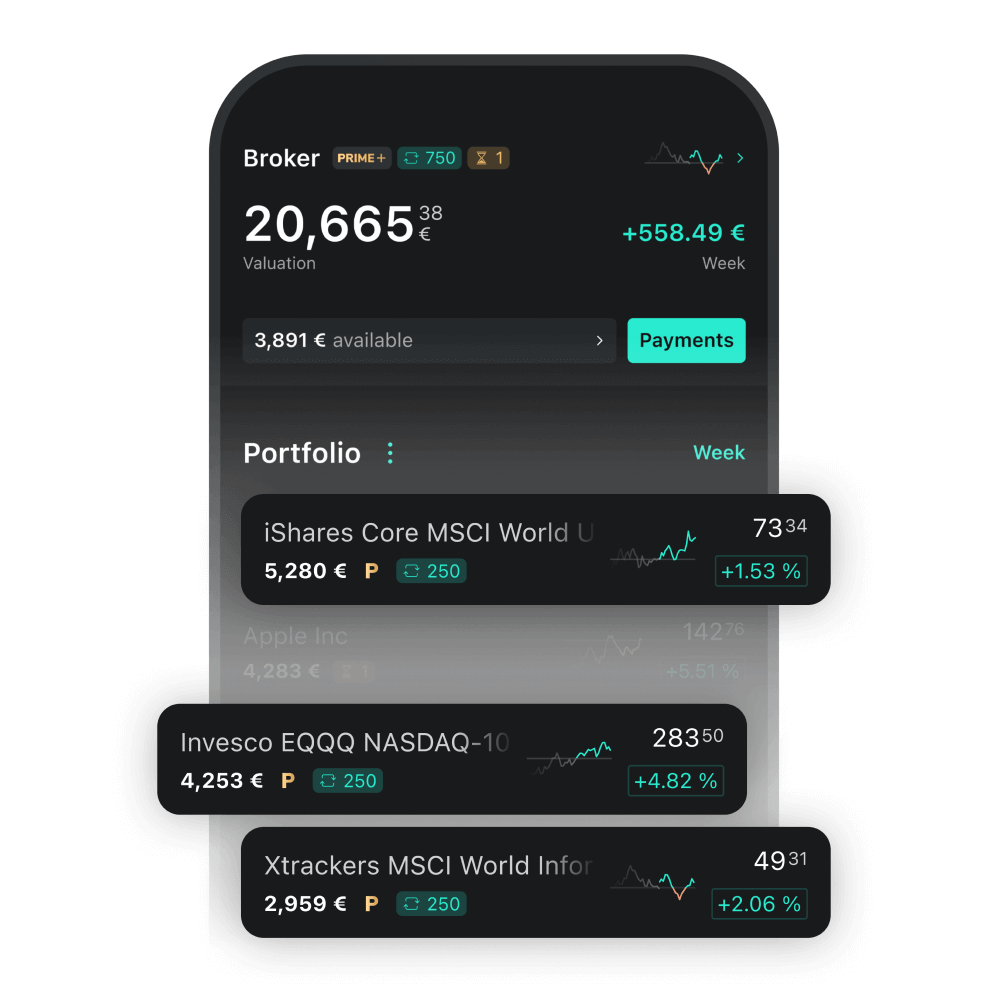

Benefit from savings plans from €1, trading flat rate and interest with the PRIME+ Broker.

There are risks associated with investing.

For new clients: 4% p.a. interest (Baader Bank) on up to €1 million for 4 months. Thereafter 2.6% p.a. variable interest on up to €100,000. Interest only with PRIME+. Learn more.

+1 million build their wealth |

|

+ €20 billion in client assets |

|

Top-rated app |

|

Security Custody of securities with |

Invest in your

financial future

|

Savings plans starting from €1 - for ETFs, stocks and funds. |

|

Trade as you like - Via the app on iOS and Android or on the web. |

|

Put your cash to work - Earn 2.6% interest p.a. on up to €100,000 in PRIME+. |

All in one broker

Interest.

Earn 4% p.a. interest on cash up to €1 million for the first four months

- in the PRIME+ Broker with trading flat rate.

Derivatives.

Implement your market perspective with over 375,000 derivatives.

Commodities.

Simply invest in commodities and precious metals or set up savings plans from €1.

Get started

in 3 steps

Investing made easy

– via app and web

Frequently asked questions

You are welcome to transfer your portfolio to Scalable Broker. You can find all information here .

To do this, log in to the Scalable app or on the web and authorise the securities account transfer digitally under Profile > Products > Securities transfer. After the securities transfer has been submitted, you can check the status of the transfer here.

If you have any questions about the status, please contact your source bank as soon as the status "Source bank has received the instruction" has been reached. The name and BIC of the source bank will be displayed in the detailed view.

Securities account transfers initiated by your house bank cannot be accepted. Please note that it may take several weeks until the entire process of the transfer is complete.

You will select an amount for your initial deposit during the registration process. This amount must be at least 1 euro. Your available balance can be paid out in full or in part at any time. A high deposit is recommended in order to be able to start trading stocks, ETFs and funds immediately.

The registration is completed online and only takes a few minutes. Registration via iOS or Android mobile app is also possible. You then identify yourself using the POSTIDENT identification procedure of our partner Deutsche Post (this step is not necessary for you if you already use our wealth management service with securities account management at Baader Bank).

The account opening by the custodian bank usually takes up to three working days. As soon as your securities account has been opened and the initial deposit has been made, you can start trading.

Orders can be placed on gettex, a stock exchange of Bayrische Börse AG, or Xetra, operated by Deutsche Börse AG. In principle, neither brokerage fees nor exchange fees are charged on gettex1. The public law structure guarantees the neutrality that is indispensable for safeguarding the interests of market participants, investors, and issuers.

The order fee is 3.99 euros per order, also in the PRIME Broker or PRIME+ Broker1.

In addition to that, there is a trading fee for Xetra. For Scalable Broker this is only 0.01 % of the executed volume (minimum 1.50 euros). The trading venue fee covers all third-party costs for trading and settlement. The settlement is carried out by the custodian bank.

1 Product costs, spreads, inducements and crypto fees may apply. View overview of all costs.

On gettex, you can usually trade ETFs, shares, and funds Monday through Friday from 8 a.m. to 10 p.m. Stock exchange holidays are excluded. You can find gettex's trading calendar here.

On Xetra, you can trade Monday through Friday from 9 a.m. to 5:30 p.m. Stock exchange holidays are excluded. You can find Xetra's trading calendar here.

On trading days, the Scalable Broker allows orders to be placed around the clock. From 12:15 a.m. to 11:30 p.m., you can place or cancel orders in our app or online by logging in to your Scalable Capital account. Stop and limit orders created outside trading hours are executed at the next possible time during trading hours. Market orders are generally only valid for the day on which they are created. If they are created before the opening of the stock exchange, they are executed at the next possible time during trading hours. Market orders placed after trading closes expire.

Outside trading hours, a moon symbol appears next to the last quote in the view of the security. This is an indicator that the stock exchanges are closed and trading is currently not possible.

Please note that different trading hours may apply to certain derivatives. You can find further information in the “Key Investor Information Document” or on the providers’ websites.

In principle, all ETFs, shares and funds that are traded on the gettex stock exchange are available to you.

Additionally, you can trade more than 375,000 derivatives by Goldman Sachs, HSBC and HypoVereinsbank onemarkets. You can easily find out whether a security can be traded by using the search function of the broker screen in our app or online. Simply enter the name, the security identification number (WKN), or ISIN.

You can also buy registered shares via Scalable Broker. The custodian Baader Bank will take care of the registration for you. You will not incur any costs for the registration performed by Baader Bank.

You can trade more than 375,000 derivatives in Scalable Broker. You can choose between derivatives by Goldman Sachs, HSBC or HypoVereinsbank onemarkets. To be able to trade derivatives, you have to successfully conduct the suitability test. This test is designed to assess your knowledge and experience with regards to derivatives. This is required since trading in derivatives can result in high and quick losses.You can check the availability of a specific derivative with our Derivatives Search.

In the Scalable Capital Broker, you have various financial products at your disposal with which you can invest in the gold market. For example, you can invest in ETCs that invest in physical gold.

In the Scalable Broker, you can also trade fixed-income bonds as well. We will gradually expand our bond offering.

New initial public offerings (IPOs) can currently not be subscribed to via the Scalable Broker. We make every effort to ensure that shares can be listed on gettex and traded via our platform on the first trading day following a successful IPO.

You cannot buy fractions directly. However, with all savings plans we also buy fractions of ETFs for you so that your savings amount can be fully invested. As long as your savings plan is active, these fractions are repeatedly combined to form whole number securities.

If you want to sell a security that has been saved and therefore contains fractions, you can of course also sell the resulting fractions again. Please note that no individual fractions can be sold, but rather the entire position must be sold.

Limit order: With this order, a limit price can be defined. The order will only be executed at this predefined price or better. This way, you can protect yourself against sudden price jumps. Due to the limit, there is a possibility that the order can be executed partially or not at all. The limit order is valid for 360 days. During this period, it can be cancelled at any time, provided that not all ordered items have been executed.

Stop order: With this order, a stop price can be defined. When the stop price is reached, your order will be activated as a market order and executed at the best possible price during trading hours. Under certain circumstances, this price can deviate significantly from the stop price due to price jumps. It may happen that the order is never activated and therefore not executed.

The stop order is valid for 360 days. During this period, it can be cancelled at any time, provided that not all ordered items have been executed.

Stop limit order: As a combination of the two preceding order types, with this order both a limit and a stop price are specified. When the stop price is reached, your order will be activated as a limit order and then executed only at the limit price or better. This way, you can protect yourself against sudden price jumps. On the other hand, it may happen that the order can only be partially executed or not at all. The stop limit order is valid for 360 days. During this period, it can be cancelled at any time, provided that not all ordered items have been executed.

Please note: If you enter both a stop and a limit price in the order screen, this does not constitute an OCO order. The Scalable Broker does not currently offer a One-Cancels-the-Other ("OCO") order.

Market order: This is only offered for sell orders. For buy orders for which no limit price is defined (see above), a security limit is automatically set (max. 5 % above the last ask price). This protects you against significant price jumps when buying.

Sell orders can also be placed as market orders. In this case, the order is executed at the next possible price during trading hours. Due to price jumps, this may differ significantly from the last price at the time the order was placed. The market order is only valid for the trading day on which it was placed.

Directly after a security purchase, you can also create automatic orders with which you can realise potential profits or limit losses:

Take-profit order: The take-profit order can be created directly after a security purchase. It is a limit order where you set a price above the buy price at which a security is automatically sold. The aim is to realise potential profits before the price falls again.

Stop-loss order: A stop-loss order can be created after a security has been bought. With a stop-loss order, you set a price below the purchase price, which may be reached or fallen below at the maximum. If this occurs, a sell order is triggered. With a stop-loss order, you can determine the maximum loss you can make with a security. This allows you to limit the risk of larger losses to a certain degree.

To adjust a savings plan, click on the security with the savings plan that you want to adjust. On the overview page of the security, click on the current savings plan displayed below the chart (in the app) or on the top right of the screen (in the web browser). Change your desired amount, execution date, frequency and inflation adjustment and click on "Set up savings plan" to confirm.

To adjust the execution date and frequency of a savings plan, click on the security with the savings plan that you want to adjust. On the overview page of the security, click on the current savings plan displayed below the chart (in the app) or on the top right of the screen (in the web browser). Change the execution date and frequency, and click on "Set up savings plan" to confirm.

To suspend a savings plan, click on the desired security. On the overview page of the security, click on the displayed savings plan, e.g. "50 euros monthly". If you are in the mobile app, your savings plan will be displayed below the chart, in the desktop version you will find it at the top right. Click on "Delete savings plan" here to deactivate the savings plan. A very short-term deactivation of a savings plan may no longer be processed. Of course, you can reset the savings plan at any time.

To add or remove inflation adjustment, click on the security with the savings plan that you want to adjust. On the overview page of the security, click on the current savings plan displayed below the chart (in the app) or on the top right of the screen (in the web browser). Add a percentage value by which the savings plan rate should increase over time or click on “Inactive” if you would like to remove it and click on "Set up savings plan" to confirm.

If you are liable for tax in Germany, you will receive an annual tax certificate for your custody account and your clearing account, provided you have carried out tax-relevant transactions in the year.

As a rule, this will be made available to you for the respective past year by the end of April of the following year.

Please note: if you have terminated your portfolio, you will receive your annual tax statement by post to the address you have provided. This also applies if you have another active portfolio or use other products for which the custodian bank is also Baader Bank (e.g. OSKAR).

If you only use one product at Baader Bank (the broker or asset management) and your account is active, you will receive your tax assessment for the following year electronically in the mailbox of your Scalable customer area.

With an exemption order, you instruct your bank to exempt accruing investment income from automatic tax deduction. Without this order, the bank will pay 25 % capital gains tax as well as 5.5 % solidarity surcharge and, if applicable, church tax to the tax office.

The statutory maximum limits for an exemption order of an individual are 1,000 euros and 2,000 euros for a joint exemption order of a married couple or registered partner.

To set up or change an exemption order, please log into your personal client area on our website and open the "Profile" menu item. In the "Taxes" section, you can set up or change your exemption order.

Please note: In the case of a joint exemption order, the maximum amount of 2,000 euros may not be split between both accounts, as the custodian bank would otherwise be unable to process the orders. The joint exemption order can only be set up on one account and will also be applied to the spouse's account in the Baader Bank system.

An exemption order that has been set up applies to all your business relationships with the custodian bank. For example, if you have asset management with us and securities account management with Baader Bank, the exemption order set up for this will also apply to Scalable Broker and other relationships with the custodian bank. The display in your personal client area shows you the entire exemption order deposited with the custodian bank.

Please submit your exemption order before the end of the current year. Exemption orders are always valid from 1 January of the current year or from the beginning of the business relationship.

You have the choice between three plans:

FREE Broker:

All savings plans on shares, ETFs and other exchange-traded products (ETP) as well as buys with an order volume of 250 euros or more in all products of our PRIME partners Invesco, iShares by BlackRock and DWS Xtrackers (Xetra trades excluded) are free of charge1. For all other trades on gettex, order fees of 0.99 euros apply1. For sales of PRIME ETFs, fees of 0.99 euros are charged in the FREE Broker1.

PRIME Broker:

For 2.99 euros per month (billed annually at 35.88 euros), in addition to savings plans without order fees on shares, ETFs and other exchange-traded products (ETP), you receive an unlimited number of trades on gettex without order fees from 250 euros order volume1. Trades below 250 euros cost 0.99 euros on gettex1. With the PRIME Broker, Crypto ETPs are subject to a reduced spread surcharge (see below) in trading and in the savings plan. You also receive better conditions for real-time payment with Instant (0.69 %). You can also create as many portfolio groups and price alerts as you wish.

PRIME+ Broker:

With PRIME+ Broker, you enjoy all the benefits of PRIME Broker with flexible monthly payments of just 4.99 euros per month, plus interest on uninvested balances up to 100,000 euros on your clearing account (2.6 % interest p.a.)2.

You can change to another broker plan at any time free of charge. View all fees per price model.

Regardless of the model you choose:

Gettex trades:

All trades on gettex below 250 euros are charged with 0.99 euros order fee. This applies to all our broker plans1.

Xetra trades:

For order execution via the Xetra stock exchange, all clients incur a fee of 3.99 euros per trade plus a trading venue fee (0.01 % of the order volume, min. 1.50 euros), regardless of the pricing model1.

Crypto spread surcharge:

In addition to the above fees, the spread surcharge applies for each execution of a savings plan or trade in a crypto ETP. This amounts to 0.99% of the executed savings plan or order volume for FREE Broker clients or 0.69% of the executed savings plan or order volume for PRIME Broker and PRIME+ Broker clients1.

Any spread surcharges incurred will be displayed to you under "Cost information" prior to the placement of trading orders or when setting up or changing a savings plan.

Product costs for crypto ETPs

Ongoing product costs are incurred for trading in crypto ETPs1.

Real-time payments via Instant:

Real-time payments via Instant cost 0.99% in the FREE Broker model, and only 0.69% of the deposit amount in PRIME Broker and PRIME+ Broker. The following applies to every deposit: From 5,000 euros, every additional euro is free of charge.

There are no additional costs such as securities account fees, flat-rate third-party fees, or issue surcharges.

Please note: There is a reference in the client documentation to an administration fee of 0.75% p.a. This refers exclusively to our separate product, "wealth management." If you only use our broker, this fee is not relevant for you.

View list of all possible fees of the Scalable Broker by model.

1 PRIME Broker / PRIME+ Broker: 0 euros for trades from 250 euros volume, below 0.99 euros.

FREE Broker: 0 euros for purchases of PRIME ETFs (all ETFs from Invesco, iShares, Xtrackers) from 250 euros volume, 0.99 euros for other trades.

All broker plans: 0 euros for savings plan executions. Product costs, spreads, inducements and crypto fees may apply. Learn more.

2 Conditions apply scalable.capital/interest

For new clients: 4% p.a. interest (Baader Bank) on up to €1 million for 4 months. Thereafter 2.6% p.a. variable interest on up to €100,000. Interest only with PRIME+. Learn more.