Account transfer

successful

The transfer of the Baader accounts (Scalable Broker and Wealth) to the new Scalable account has been successfully completed.

The transfer has been successfully completed

We have transferred for you:

Securities with fractions | |

Savings plans | |

Cash and Credit | |

Tax data, acquisition data, loss pots and tax exemption order (“Freistellungsauftrag”) | |

Documents, transaction and performance history |

Your Baader accounts including clearing accounts have been closed permanently. Any other business relationships with Baader Bank (OSKAR, Smartbroker, finanzen.net zero, TradersPlace, JoeBroker) are not affected. Due to legal requirements, Baader Bank is obligated to store your contract data for a specific period even after the account closure.

Process of the account transfer

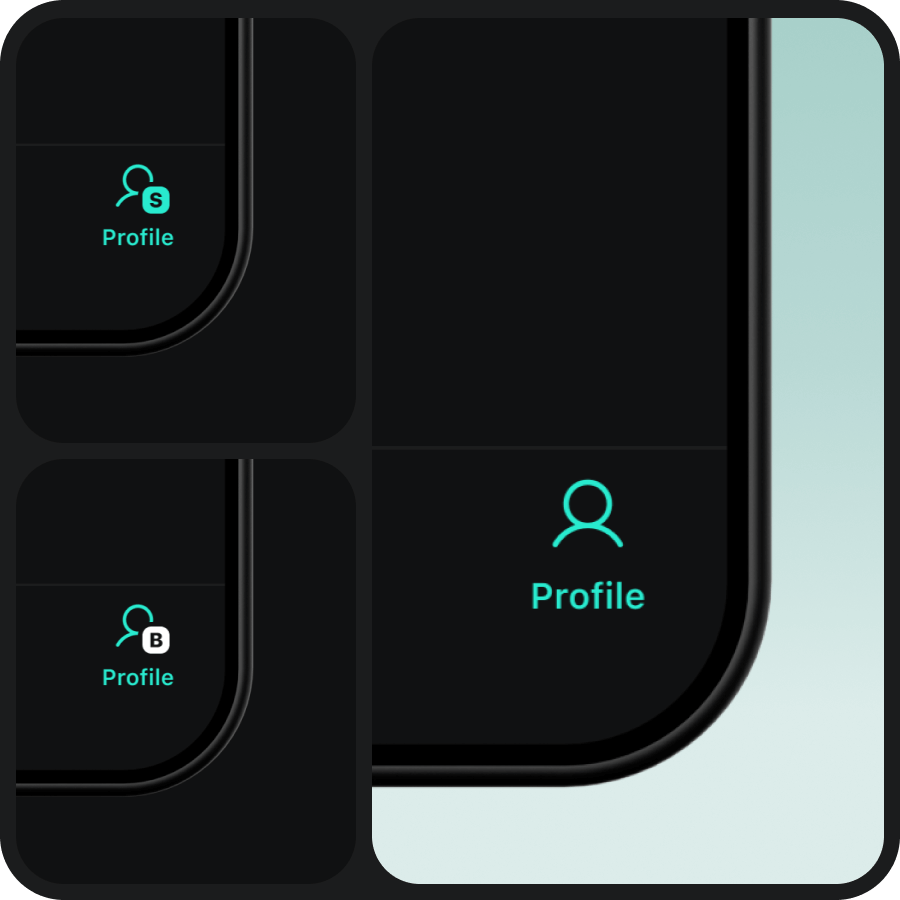

Uncertain whether this applies to you? Navigate to Home, then tap Home again: If you observe two accounts listed at the top, the following changes are relevant to you.

Date |

Status |

Step |

|---|

From 1 August 2025

Broker (Baader Bank)

- 1 August: Creation and changes of savings plans no longer possible in your Baader account.

- All savings plans with the execution dates 1, 4 and 7 August will still be executed in your Baader account.

- From 8 August: All savings plans will be executed in your new Scalable account – incl. the ones previously instructed on Baader accounts.

- If you already had a saving plan for the same security in your Scalable account, the savings plans will be summed.

- All holdings like your stocks, ETFs and cash will remain in your Baader account until the weekend of the transfer to the new Scalable (please refer to the last step of this table).

- In case your savings plans are debited from your clearing account, please ensure sufficient cash in your new Scalable account until 8 August.

Wealth (Baader Bank)

- Until 2 December 2025 withdrawal plans will be executed in your Baader account.

- After the weekend of the transfer, your savings and withdrawal plans will continue via your Scalable account.

- Important: Please note that each Wealth portfolio will be assigned a new IBAN.

From 1 October 2025

Broker (Baader Bank)

- New applications for and changes to Scalable Credit will not be possible anymore. Existing Credit can still be used.

From 10 October 2025

Broker and Wealth (Baader Bank)

- Changes to personal data will not be processed anymore in your Baader account. This includes changes to names and addresses.

Broker and Wealth (Baader Bank)

- Incoming security transfers will not be processed anymore.

- Pending transfers will still be completed.

From 1 December 2025

Broker (Baader Bank)

- Buy orders are only possible in the new Scalable account.

- In your Baader account all pending buy orders will expire.

From 2 December 2025

Broker (Baader Bank)

- From 2 December, withdrawals can no longer be instructed for the Baader account.

- Remaining cash balances will be transferred to the new Scalable automatically.

- Transfers to your Baader account from 6 December will be returned to the sender’s current (reference) account.

Wealth (Baader Bank)

- Incoming deposits via SEPA direct debit are already being rejected. Deposits via SEPA transfers will continue to be possible.

- From 2 December, withdrawals can no longer be instructed.

- Remaining cash balances will be transferred to the new Scalable automatically.

- Transfers to your Baader account from 6 December will be returned to the sender’s current (reference) account.

From 3 December 2025

Broker (Baader Bank)

- Buy and sell orders are only possible in the new Scalable account.

- In your Baader account all pending sell orders will expire.

- For securities in your Baader account, the transfer has been initiated. They will be tradable again after the weekend of the transfer in your new Scalable account.

Broker and Wealth (Baader Bank)

- Changes to the tax exemption orders (“Freistellungsauftrag”) will not be processed anymore.

- Please make any necessary changes to tax exemption orders (“Freistellungsauftrag”) as soon as possible.

Broker and Wealth (Baader Bank)

- Changes to reference accounts will not be processed anymore in your Baader account.

From 6 - 7 December 2025

Broker and Wealth (Baader Bank)

- The transfer will take place over the weekend outside of trading hours.

- Prior to the transfer all functionality of your Baader account will be deactivated (see previous steps).

- You can continue to trade in your new Scalable account throughout the transfer process.

- On the weekend of the transfer access to your client area will be restricted temporarily.

Your new Scalable account then includes:

- All securities with fractions

- Savings plans

- Cash and Credit

- Tax data, acquisition data, loss pots and tax exemption order (“Freistellungsauftrag”)

- Documents, transaction and performance history

Upon successful transfer your Baader account will be closed.

Frequently asked questions

Your new Scalable account now includes all securities with fractions, savings plans, cash, credit, tax data, acquisition data, loss pots, tax exemption order (“Freistellungsauftrag”), documents, transaction and your entire performance history. Your Baader account has been closed.

You have received separate information from us if individual securities have (not yet) been transferred. This can be due to, among other things, ongoing corporate actions, dividends, knock-outs, or maturities. Upon completion, the respective securities and cash (e.g., dividend payments) will be automatically transferred to your new Scalable account.

Your new Scalable Account is not affected. The cancellation refers to your previous Baader Bank custody account. This account was closed as part of the successful transition to the new Scalable (see What happened to my Baader Account?. Your business relationship continues on the basis of the Scalable General Terms and Conditions.

Your securities account, including the cash account, has been successfully transferred to the new Scalable. Your tax exemption order (Freistellungsauftrag) was included as well.

- For 2025, the Scalable tax exemption order is instructed up to the unutilised amount of your Baader Bank tax exemption order. Should the entire amount have already been utilised, the Scalable tax exemption order for this year is €0.

- From 2026, the tax exemption order is instructed up to the amount instructed at Baader Bank. This was transferred to Scalable.

In your Scalable Mailbox you can find the Scalable tax exemption orders, both with the title "Submitted tax allowance". The validity (“Gültigkeit”) can be found on page 2.

In your profile within the client area you can view the tax exemption order granted for 2025 as well. Please note that if the entire amount for 2025 has already been utilised, a value of €0 will be displayed for 2025.

In which cases has the tax exemption order not been transferred?

- You maintain ongoing business relationships with Baader Bank outside of Scalable: In this case, your tax exemption order remains with Baader Bank. If desired you can instruct changes to your tax exemption order at Scalable via the client area.

- You already have a tax exemption order for your new Scalable account: In this case any remaining Baader tax exemption amount cannot be transferred automatically. You can instruct changes to your tax exemption order at Scalable via the client area. Your existing exemption order with Scalable Depot will be continued in the same amount you deposited at the time of the transition.

- A joint exemption order for married couples and registered partnerships with Baader Bank has been set up. In individual cases, the data of both parties could not be reconciled.

Orders that were not yet executed in the Baader account before the transfer have expired. You can place them again in your Scalable account with just a few clicks. To do this, go to Transactions and select the corresponding orders you wish to place again.

You can find your Scalable IBAN in the product details. Please use only this IBAN for deposits from now on, and adjust your standing orders if necessary. You have received a separate Scalable IBAN for each Wealth account; the Broker IBAN remains the existing one.

If the deposit for your savings plans is made by direct debit, the switch to the new IBAN is automatic. You do not have to do anything.

Loss pots and tax exemption orders (“Freistellungsauftrag”) were in general transferred. There are the following exceptions:

You maintain ongoing business relationships with Baader Bank outside of Scalable: In this case, your loss pots and tax exemption order cannot be transferred. If desired you can instruct changes to your tax exemption order at Scalable via the client area. For details on how to request a loss certificate, please refer to the information available here.

Single securities have not (yet) been transferred: In this case, the loss pot will be transferred with the transfer of the last remaining security. For details on how to request a loss certificate, please refer to the information available here.

If no securities were transferred to the new Scalable (i.e., you did not hold any securities), Baader Bank will automatically issue you the loss certificate for the 2025 tax year.

You already have a tax exemption order for your new Scalable account: In this case a tax exemption order instructed at Baader could not be transferred automatically. You can instruct changes to your tax exemption order at Scalable via the client area. Loss pots were transferred as long as you did not maintain other ongoing business relationships with Baader Bank and no securities remained (see above).

Yes, both your Broker and Wealth accounts have been transferred to the new Scalable in the same time frame (see table for details).

You can reach us through our customer service (keywords: “The new Scalable: Transfer”).

Documents such as transfer-out confirmations or information on securities events in the Baader account will be provided in your Scalable Mailbox. Details on the annual tax certificate can be found here.